What is a crypto ATM?

A cryptocurrency ATM, also known as bitcoin ATM, is used to buy/sell cryptocurrencies with cash. Unlike regular ATMs, it doesn’t exactly withdraw cash from holding assets. Instead, it allows users to buy different types of cryptocurrencies (BTC, ETH, USDT, LTC, XMR, XRP) by directly inserting cash into the machine.

Similarly, a crypto ATM lets users sell their holdings by accessing their wallets and selling the intended amount through a crypto exchange. Once the sale is confirmed, like in regular ATMs, cash is dispensed out of the machine.

How to buy/sell crypto from a crypto ATM

Various companies use different protocols to conduct the buy/sell process, so be absolutely sure to read the directions before using a specific crypto ATM.

Having said that, here’s a general rundown of the process:

How to buy cryptocurrency from a crypto ATM

The user can provide an existing wallet address to send their newly-purchased crypto or create a new wallet instantly on the machine. If an existing wallet is selected, the ATM will ask you to scan the QR code of the wallet on the ATM scanner. Once the QR code is scanned, the BTC will be transferred to the wallet just as fast as a non-ATM crypto transaction.

Selling crypto at a crypto ATM

The selling process through a crypto ATM is generally similar to the buying process, with a few key differences.

Once the amount of BTC intended for sale is selected on the screen, the user will have to scan their crypto wallet. Once the wallet address is confirmed and the sale is permitted, the user will have to wait for the Bitcoin blockchain to confirm the transaction. Once confirmed, it will dispense the requisite cash from the ATM.

Depending on the ATM company and the dollar amount of the transaction, the user may have to provide their phone number and photo ID for verification purposes. Also, there will be a minimum and maximum transaction amount predetermined by the ATM company, so make sure you’re under the limit. Transaction minimums and maximums are generally in the range of $10-$10,000.

Fees and security concerns of crypto ATMs

Crypto ATMs generally charge users substantially higher fees than online crypto exchanges. In the case of either buying or selling using an ATM, a user can expect to be charged a hefty premium between 7%-10% of the market price.

For instance, if 1 BTC costs $60,000, the user will have to pay around $66,000 to buy 1 BTC from a crypto ATM. This makes using a crypto ATM one of the least cost-effective strategies for purchasing digital assets.

However, even though the fees are high, crypto ATMs are still convenient and reliable. This method of transacting is strictly regulated in the United States to protect users and mitigate the risk of scams and robbery. These ATMs are considered Money Service Businesses and fall under the jurisdiction of the Financial Crimes Enforcement Network (FinCEN).

Under FinCEN, crypto ATMs have to comply with several policies like Anti Money Laundering, customer service protocols, and platform audits before they can go live.

Popular crypto ATMs

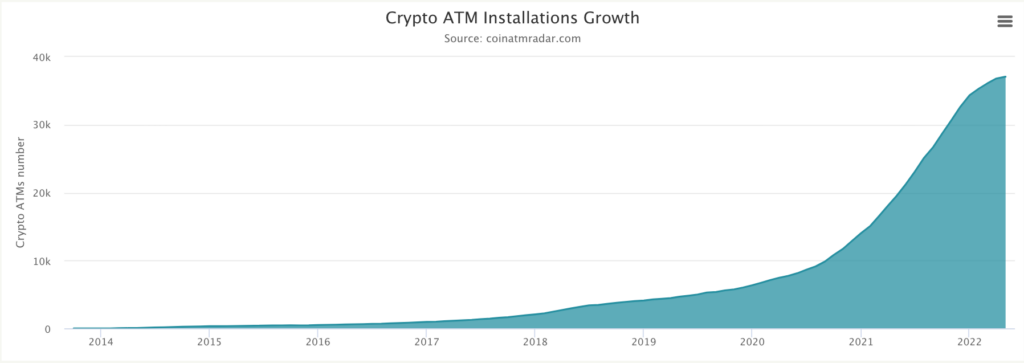

Growth in the cryptocurrency market has directly led to an increase in the number of cryptocurrency ATMs, which are opening up across the globe. Today, there are more than 33,000 crypto ATMs in the world. Nearly 28,000 of those ATMs are located in the U.S., with a small number present in the E.U., U.K., Canada, Spain, and Switzerland.

Source: Coinatmradar

As the number of people using crypto ATMs increases, more companies are getting into the business. Currently, the top 3 operators, Bitcoin Depot, CoinCloud, CoinFlip, account for over 40% of the market share for crypto ATMs.

How to Find a Crypto ATM Near You?

In the U.S., almost every major city has at least one crypto ATM. Other major cities around the world are likely to have these machines as well, but they aren’t located everywhere just yet.

You can find your nearest crypto ATM using Coinatmradar.io. This site tracks a large number of ATMs in the world with all the necessary information you need to choose the best one for your needs. Simply put in your address and your preferred cryptocurrency, and it will display all the available crypto ATMs in your area.

A necessary technology

As cryptocurrency becomes part of the world economy, the need for machines to convert cash to crypto in real-time will skyrocket. As with other developing technologies, problems like high transaction fees and lack of availability in smaller towns will also be solved. In time, crypto ATMs will likely become as normalized as traditional ATMs and a regular part of our lifestyle.