Every area of life has debates. Whether you’re debating beach vacations versus mountains or seafood versus steak for dinner, there are always decisions to be made.

What is for sure is that you’ll likely take a vacation (even if it’s only a staycation), and you will end up getting something to eat (which could be a compromise of getting a surf and turf plate).

Debates are common in the investing world, too, where the debate is usually lump sum investing versus dollar cost averaging, and if you understand the nuances of those two investing strategies, you’ll understand why there is a debate.

If you’re new to these terms, though, let’s start with…

Lump sum vs. dollar cost averaging

Fortunately, the meanings of these two terms are easy to understand. Dan Hunt for Morgan Stanley writes,

With lump-sum investing, you invest all at once…

That’s right, you take all of your available cash and invest it all at the same time. As in right now.

On the other hand…

With dollar-cost averaging, you methodically invest your cash in equal amounts over a period of time – for example, investing $120,000 in $10,000 monthly installments over 12 months.

In other words, you may not invest all of your available cash all at once or you may invest the smaller amounts of available cash that you do have consistently over time… consistency being key with this approach. After all, without consistency, you would just be investing a small(er) one-time investment.

And as with all debates, there are pros and cons to each of these investment strategies.

The advantages of lump-sum investing? All of your money goes to work for you right away.

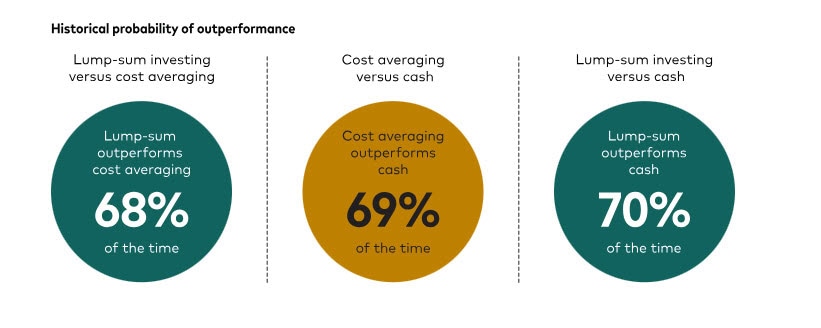

You can think of it like owning a business with employees where every employee working could generate profit for your company. In this scenario, the more employees (dollars) working at the same time, the possibility of a bigger and quicker return on your investment. And the data back this up! Lump sum investing outperforms dollar-cost averaging 68% of the time.

So why doesn’t everyone diversify with a lump sum? When you invest it all at once, there is the possibility of bigger losses because you are all in. A lump sum investment might coincide with peak prices – leaving you with losses from day one.

Dollar-cost averaging means lower risk of loss. And when prices are high, it’s much less challenging psychologically to dollar-cost average your way into a new position. Even a very expensive one.

Dollar-cost averaging with bitcoin

As an example, let’s take bitcoin. Michael Saylor’s company Strategy (formerly MicroStrategy) has been adding bitcoin to the company’s balance sheet for over four years.

Bitcoin’s price is high and continues to increase. A recent Bloomberg story tells us:

The mini rally in Bitcoin over the past few trading sessions has made every purchase of the cryptocurrency by Michael Saylor’s Strategy over the last four plus years profitable.

As the price of bitcoin fluctuated over the years, many of Strategy’s purchases were periodically under water. That’s a chance you take with dollar-cost averaging – and every new purchase modifies the average cost of your position.

Strategy’s consistent purchases, dollar-cost averaging into a larger bitcoin position regardless of price, has certainly paid off.

And dollar-cost averaging into a new position is often much easier from a psychological perspective. With dollar cost averaging, you’re in the market, so you’re able to participate in any gains from your investments, and because you’re not all in, if the market takes a downturn, you can sleep well at night knowing that you didn’t lose everything… because you hadn’t invested everything.

On the flip side of that, because you didn’t invest everything as a lump-sum, you could also be missing out on bigger overall gains that could be available with a lump-sum investment. You have to understand this in advance.

Which choice is right for you?

That’s a great question, and for most people the answer will come down to how risk averse they are and how much the difference in potential gains means to them.

According to investment giant Vanguard:

And that leads us to the bigger point:

It’s more important to actually be invested than to choose an investment strategy.

If you are comfortable with taking on more risk, lump-sum investing historically offers bigger overall gains.

Having said that, dollar cost averaging helps the risk averse investor to sleep well at night while also historically receiving better gains than not investing at all (staying in cash).

And the beautiful thing for you is that, with BitIRA, you can take advantage of the potential of the cryptocurrency market using either investment philosophy.

You can open your digital IRA right now and deploy a lump sum to diversify with crypto. Then you have exposure to crypto’s growth potential.

Alternately, you can cost average. Once you’ve opened your digital IRA with a $10,000 minimum deposit, there’s NO minimum order size. You can begin adding to your crypto position with a regular series of smaller transactions. While that does lower your growth potential, it also lowers your loss potential.

Even though lump sum investing tends to bring better outcomes, it’s not for everyone! That’s why we developed the My BitIRA platform with the flexibility to appeal to everyone. To lump sum investors and dollar-cost averagers alike. You can get started right now – just open your digital IRA (takes less than 10 minutes).

Alternately, if you’re not yet sure whether diversifying with cryptocurrencies is right for you, get your free Insider’s Guide to Digital IRAs. It’s a great place to begin your due diligence research.