What You Need to Know Ahead of the May 2020 BTC Halving

In mid-May of 2020, Bitcoin is going to reward its miners with half of what they previously received for validating new blocks in its blockchain. Everyone is curious about how this 2020 event will play out. We have two previous Bitcoin halvings over the last eight years to look at for some context, but recent global and economic events—as well as the growth of the cryptocurrency community—point to current circumstances as unique.

What is the Bitcoin halving?

A Bitcoin halving occurs after 210,000 blocks are mined, at which point the number of Bitcoins produced as a reward for each successful block mined is cut in half. Also known as a block halving, it tends to take about four years for the required 210,000 blocks to be mined.

As a refresher, Bitcoin is a cryptocurrency that can be exchanged with other currencies, or it can be used to pay for goods and services with vendors who opt in to accept it. One of its lauded features is its blockchain ledger, which keeps track of transactions and maintains transparency.

How does this blockchain work? When Bitcoin transactions are made, a “miner” verifies their authenticity and solves a “proof of work” function; that miner then gets to add the transactions as a block to the blockchain. Mining is very resource-intensive and involves solving extremely complex cryptographic hash functions associated with Bitcoin (or whatever cryptocurrency is being mined).

The incentive for miners performing this work with Bitcoin is that they are rewarded with Bitcoins for every block they successfully mine. This incentive is what is cut in half every 210,000 blocks, with every Bitcoin halving.

Why does Bitcoin halving take place?

This event was coded directly into the Bitcoin protocol by its creator, Satoshi Nakamoto, as a way to slow the supply of new Bitcoins coming into existence in a controlled way.

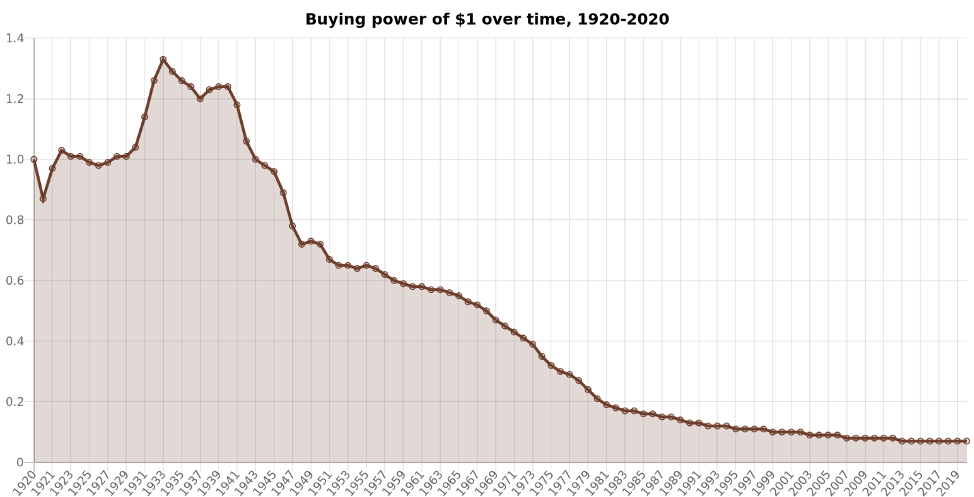

The idea is that gradually slowing down the production of Bitcoin and limiting its supply will keep Bitcoin’s value high, following the simple rules of supply and demand, and preventing inflation. The reasoning behind this comes from something Bitcoin’s mysterious founder wrote a month after it launched in 2009:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

In direct contrast to Bitcoin’s work-based rules for generating new currency, central banks around the world have been able to print money as needed. This has created vast inflation over the years. The value of the U.S. dollar, for instance, has fallen more than 90% over the last 100 years:

And so when setting out to create the first cryptocurrency, Satoshi Nakamoto coded in a finite amount of total Bitcoin to ultimately be generated, with halvings occurring every 210,000 blocks in order to gradually reduce the rate of Bitcoin production. By block number 21 million, miners won’t be rewarded anything and Bitcoin production will stop, at a point in time that is likely more than a century down the road.

To recap, the May 2020 Bitcoin halving is part of a predictable sequence of mandatory occurrences coded in Bitcoin’s protocol from its inception and designed to protect Bitcoin from inflation.

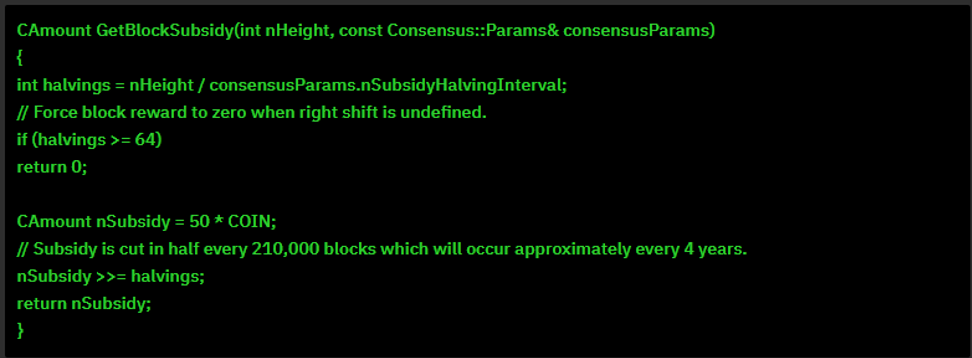

Here is the actual line of code from Bitcoin’s open source protocol, addressing the halving:

Do all cryptocurrencies undergo halving events?

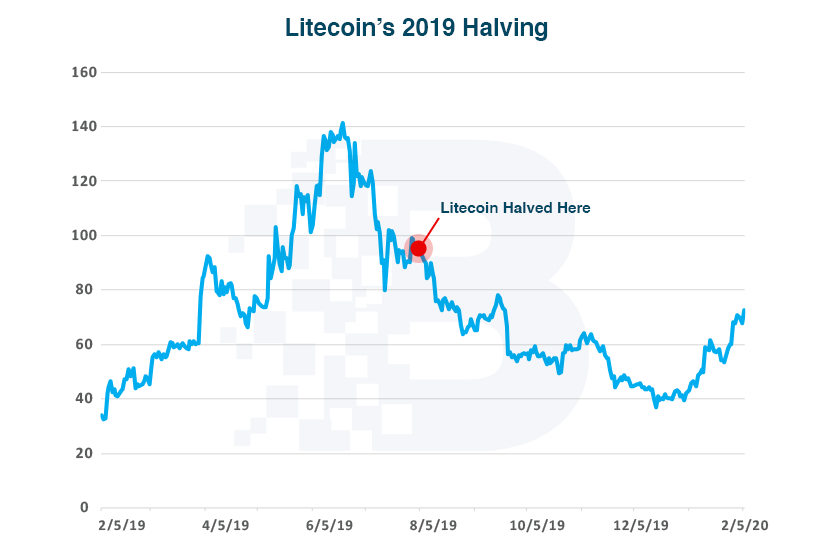

Bitcoin isn’t the only currency that leverages the anti-inflationary principles behind a halving event. Litecoin underwent its own halving in 2019. Ethereum doesn’t have largely predicted halving events, but it too rewards miners less over time under a “minimum necessary issuance policy.”

Other cryptocurrencies don’t gradually limit supply over time; they just have pre-mined supply that is doled out periodically. Ripple, for instance, has 100 billion XRP tokens already pre-mined. That is the total limit of how many Ripple tokens will ever be in existence. Only about 40% of those tokens are currently available in the market. Periodic releases of further Ripple tokens take place to gradually increase the supply until the limit is reached.

Under whatever method, these supply-limiting events are big stories in the cryptocurrency world, bringing about heavy speculation. As the original cryptocurrency and accounting for 70% of the world’s digital asset market value, no one receives more buzz than Bitcoin for its halving events.

Bitcoin Halving 2020: Expert Predictions

Supply-and-demand predicts an increase in BTC price

In any basic economics class, the first lesson is always that when supply falls or demand rises, prices increase. So, you might expect that when Bitcoin’s new supply is cut in half, prices will then quickly increase. This is a very attractive prospect, and a key driver behind the Bitcoin halving buzz.

There are certainly some that believe this halving event will force the price-per-Bitcoin to rise. Vijay Ayyar, the Head of Business for the crypto exchange Luno, recently told CNBC that $15,000 to $16,000 was a “reasonable” target price for Bitcoin to reach by the end of 2020, following the halving.

But the reality might prove to be a little less clear because there are additional variables at play.

An unintended increase in supply could drive down BTC price

Other crypto experts are less sure of this price increase because they question the miners’ potential response to the halving, and the effect that could have on pricing.

As we’ve covered, there are a number of players in cryptocurrency: traders and speculators; consumers; businesses that accept Bitcoins and other cryptos; and the miners validating transactions and being rewarded with new Bitcoins.

The miners are sometimes made up of large teams with enormous data centers. These are the groups that have collected and held onto Bitcoins for years, sometimes even hoarding it. These miners are also the ones that post-halving will see smaller rewards for every new Bitcoin they mine.

As Joseph Young for Cointelegraph explains it, “it would make sense for big mining centers to accumulate large amounts of capital before the halving to finance their operations in advance in case the price of Bitcoin does not increase right away after the halving.”

In layman’s terms, this means that some of the largest Bitcoin holders could sell some of their stake around the time of the halving to fund future operations. This would actually temporarily increase supply—potentially decreasing Bitcoin’s price tag, and leading to a short-term bear market.

Perhaps the halving won’t drive much of a price change after all

As for long-term price speculation, there would seem to be a bit clearer of a picture on what this halving event means. One would expect that a lower supply of new Bitcoin should increase prices—at least, that would be the case in a perfect vacuum.

Buy with the economics of cryptocurrencies constantly changing, we can’t look at just immediate coin supply to figure out future Bitcoin prices.

If immediate prices do remain where they are, and rewards for miners are halved, many might stop mining altogether. Previous halvings have already shaken out many small-time or novelty miners from the practice. This could limit new supply itself, which would push new halving events further down the road.

But even with the loss of these smaller miners and the smaller Bitcoin reward, this halving might not have as big of an impact on price as many believe because of the greater context in which this change will occur. As Simon Harman, CEO of blockchain tech foundation Loki, notes:

“If the reward halves, the hash rate is likely to drop off steeply. However, because there is less supply being created over time, the halving may cause the price of Bitcoin to rise, thereby increasing the value of the now smaller reward. This means that in the long run, the halving will probably not have a major impact on hash rate.”

Hash rate is the amount of computing power needed to mine each Bitcoin block. So, what Harman is implying here is that miners won’t be affected by this halving much at all in the long-term. Supply will sort itself out, potentially creating a short boom in price, but having neither a long-term price trend one direction or the other.

Clearly, speculators and pundits are all over the place in terms of these predictions. Fortunately, this isn’t the first halving to take place.

What can we learn from past Bitcoin halvings?

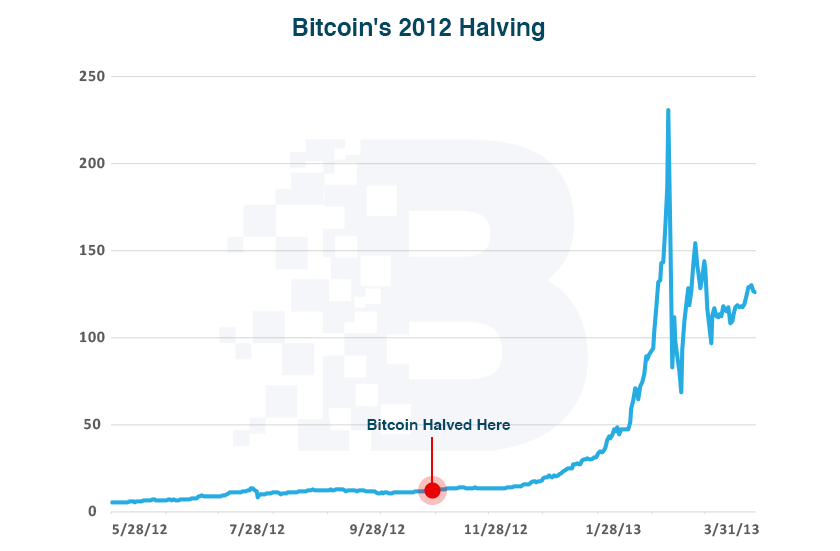

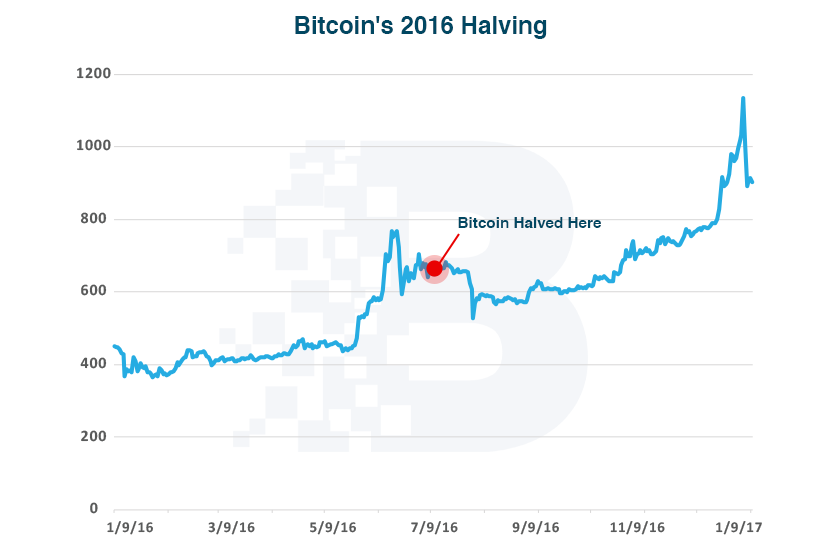

In both the 2012 and 2016 Bitcoin halvings, BTC traded flat for a short time, followed by rapid spikes. It is impossible to say that these were caused by limited new supply, since changes in demand played a major role in both of those spikes.

Alongside these last two halvings, other cryptocurrencies followed suit. In general, they all rose spectacularly. Litecoin spiked nearly 5,000% in the months following Bitcoin’s 2016 halving, while in parallel Ethereum took off from below $10 to $1400.

Both of these cryptocurrencies spiked right alongside Bitcoin in the months following the July halving. Therefore, despite being a Bitcoin-specific event, this 2020 halving could indeed move the entire crypto market.

As Robert Beadles, President of Monarch, told us: “As we approach the halving, we could see a wholly different type of cryptocurrency bull run, where the breakout is fueled not just by Bitcoin and its tailwinds, but by a desire for the asset class at-large. For example, the daily volume for altcoins a year ago was $13 billion. Today, daily altcoin volume exceeds $80 billion or more.”

Another factor to keep in mind is that both the media coverage of the Bitcoin halving as well as the overall size of the cryptocurrency community have grown significantly since both of the previous halvings. With a broader range of experience levels represented in the audience watching crypto trends than ever before, buying and selling behaviors may be less predictable—and may also be affected more by media buzz.

Of course, “Buy the rumor, sell the news” is a saying often used to describe financial markets, and cryptocurrency is no exception. The anticipation of the halving can drive an increase in Bitcoin purchases; then, after the halving, there could be a rush to sell.

How do experts recommend we prepare for the 2020 halving?

This article is intended for educational purposes, and is not intended as financial advice. The only certainty is that no one can predict with 100% confidence exactly what will happen to Bitcoin’s price in light of the halving.

We can turn to cryptocurrency experts and ask them what sorts of things we should look out for, and they have provided a few things worth watching, including:

- Trading volume

- Hash rates

- Mining profitability

BTC trading volume

The co-founder of Bitmain, Jihan Wu, suggests that any price bump could already be priced in. Wu told CoinDesk late last year that people have “started to bet on the price growth in advance.” That could be the case, as Bitcoin’s price rose in Q1 of 2020.

If the price bump has already been priced in, this means you could expect volume to remain flat even during the halving event. That’s the first indicator worth watching. If instead the volume jumps and remains inflated following the event, it could indicate pending price fluctuations either as a repeat of the 2012 and 2016 events or as a mirror of the recent Litecoin halving:

Hash rates & mining profitability

The second and third major indicators worth watching are a bit more on the technical side. Hash rates, which indicate the computational power to mine each new Bitcoin, as well as mining profitability both offer a look at what the halving might do to miners.

- Hash rates are expected to fall; if they stay down, then miners will likely continue to create new supply, and prices may not spike.

- But if mining profitability were to fall—and industry experts do not agree over how this will pay out post-halving—that will impact supply, perhaps more significantly than the hash rate.

Of course, keep in mind that Bitcoin prices don’t move in a vacuum. With the recent increase in economic volatility stemming from the coronavirus pandemic, Bitcoin already has and will continue to see price action too, particularly as individuals seek to diversify outside of fiat currency.

However, Evgen Verzun, founder of HyperSphere.ai, finds positive BTC price action surrounding COVID-19 to be a positive sign. “The most important thing to look for in anticipation of halving is whether investors really see BTC as a ‘safe haven,’” he notes, and highlights increased market trading volume and BTC price as good signs. “If nothing changes – you’d better stop even thinking about the crypto market for some years.”

The circumstances of this third Bitcoin halving render forecasting its effects far more difficult than in the two previous instances. Even experts cannot agree on the effects that the May 2020 halving will have. The entire industry will have to continue to keep a close eye on how BTC and other cryptocurrencies perform.

Source

Source Source

Source