The cryptocurrency market seems to be in the midst of yet another bull run. Historically, crypto bull runs have meant skyrocketing prices and significant fear-of-missing-out (FOMO) by investors. But instead of flying blindly into the current crypto bull run, let’s look back at previous bull markets to give us some insight as to where we could be headed.

Please note that none of the following should be taken as investment advice and should only be used for informational purposes.

What is a Crypto Bull Run?

In financial markets, a bull run is described as an extended period of appreciating prices. In the stock market, a bull run is often described as a period of 20% growth after a period of at least 20% decline. This is in contrast to a bear market when prices are steadily falling. The most recent bitcoin bull run began in 2020, but it isn’t the first bull market the industry has experienced. In fact, there have been three previous bull markets on record that can provide insight into the current bull market.

A History of Bitcoin Bull Markets

Like most other assets, Bitcoin has been valued in dollars since its inception in 2009. At first, there wasn’t a real dollar value attached to Bitcoin since there was no market of buyers and sellers, but this started to change slowly over time. One of the first Bitcoin transactions on record was when Finnish Bitcoin developer Martti Malmi sold 5,050 Bitcoin for the low price of $5.02, valuing the cryptocurrency at $0.0009 in October 2009.

Since that time, Bitcoin has experienced several bull markets, all of which have propelled its price to where it is today.

2011

2011 was a historic year for Bitcoin as in February, the price of 1 BTC eclipsed $1. But it wouldn’t stay that way for long, as the price of Bitcoin spent the first half of the year climbing higher, eventually reaching $32 before the bull run ended.

| Year | Starting Price | Ending Price | Percent Change |

| 2011 | $0.95 | $32.00 | 3,268% |

2013

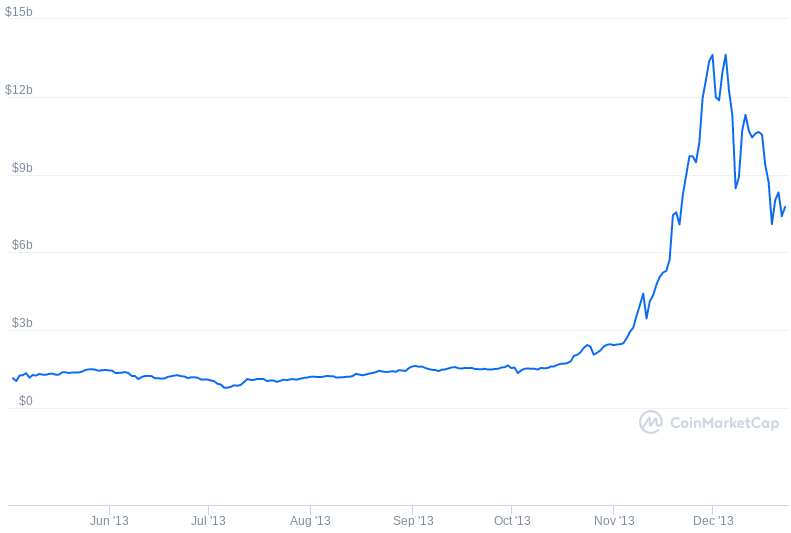

The 2013 Bitcoin bull market was quick and fierce. Between October and December, its price rose ten-fold, hitting $1,200 before receding lower. All told, the price of Bitcoin rose 9,131% over this bull run, making it the period of highest growth for the cryptocurrency.

| Year | Starting Price | Ending Price | Percent Change |

| 2013 | $13.00 | $1,200.00 | 9,131% |

2017

2017

The Bitcoin bull market in 2017 wasn’t as fruitful as other bull markets but still provided excitement to investors. The beginning of the year began with Bitcoin below $1,000 but ended with its price heading north of $20,000.

| Year | Starting Price | Ending Price | Percent Change |

| 2017 | $750.00 | $20,078.00 | 2,577% |

2020-2021

2020-2021

After the price of Bitcoin took a tumble near $5,000 in March 2020, it quickly recovered. By August, prices were heading north of $10,000 and targeting their previous high. By Christmas of that same year, Bitcoin was above $20,000 with no end to the bull run insight. As this bull market has continued in 2021, the price of Bitcoin has surged past $50,000.

| Year | Starting Price | Ending Price | Percent Change |

| 2020-2021 (to-date) | $5,058.00 | $57,487.00 | 1,037% |

At the time of this writing, the bull market of 2020-2021 is still ongoing, and it’s unclear how far the current run will last.

At the time of this writing, the bull market of 2020-2021 is still ongoing, and it’s unclear how far the current run will last.

What Causes a Crypto Bull Run?

The cryptocurrency market has undergone significant growth over the past decade. The industry has matured over the years, and bull markets have popped up due to this growth. But each bull market is distinct in its own way and caused by a variety of factors.

- 2011 – The earliest Bitcoin bull run came just as its market cap cleared $1 million. The controversial site WikiLeaks began asking for donations in Bitcoin, while Mt. Gox started to grow as one of the first centralized Bitcoin exchanges, creating a larger trading market. While Bitcoin was still the only significant player around, this is when altcoins began to surface, first with Namecoin and then Litecoin following not far behind.

- 2013 – It was in this year that the United States faced a debt-ceiling crisis. The previously enacted debt-ceiling of $16.394 trillion was reached, and there were questions of whether the country would raise its ceiling even further. This national crisis sparked Bitcoin as a hedge against rising debt levels in the US and caused its price to ascend. At the same time, financial markets started to take notice of Bitcoin, with the CME Group announcing its intention to launch Bitcoin futures contracts. This brought cryptocurrency into the mainstream financial world for the first time.

- 2017 – It was during this period, new cryptocurrency projects were starting to garner attention in the form of initial coin offerings (ICOs). Hundreds of cryptocurrencies with their own use cases and value propositions burst onto the scene, and with them, an influx of capital into the market. While many of these projects are no longer in existence, some ICOs from the 2017 bull run have continued to grow over the years.

- 2020-2021 – By the turn of the new decade, cryptocurrencies had cemented themselves as assets that were here to stay. At the same time, a global pandemic caused record money printing worldwide, and with it, fears of inflation. As a result, institutional investors and public companies started to take notice and invest their own capital into Bitcoin as a reliable store-of-value asset. This movement was led in many ways by MicroStrategy CEO Michael Saylor, who became a staunch advocate for cryptocurrency. Along with Saylor and Microstrategy, billions of dollars in capital from MassMutual, Boston Private Wealth, Square, and others flowed into the Bitcoin market, creating an increased demand for the cryptocurrency and spurring a bull market in their wake. Furthermore, a number of secondary cryptocurrency investment vehicles (like ETFs) were announced or launched during this period, which gave investors the opportunity to gain cryptocurrency exposure without holding their bitcoin directly.

The Rise of Altcoins

Altcoins are defined as any cryptocurrency that is not Bitcoin and is looking to take market share away from the industry’s leader. Some altcoins describe themselves as better alternatives to Bitcoin, while others are digital assets with their own use cases and not directly competing with Bitcoin.

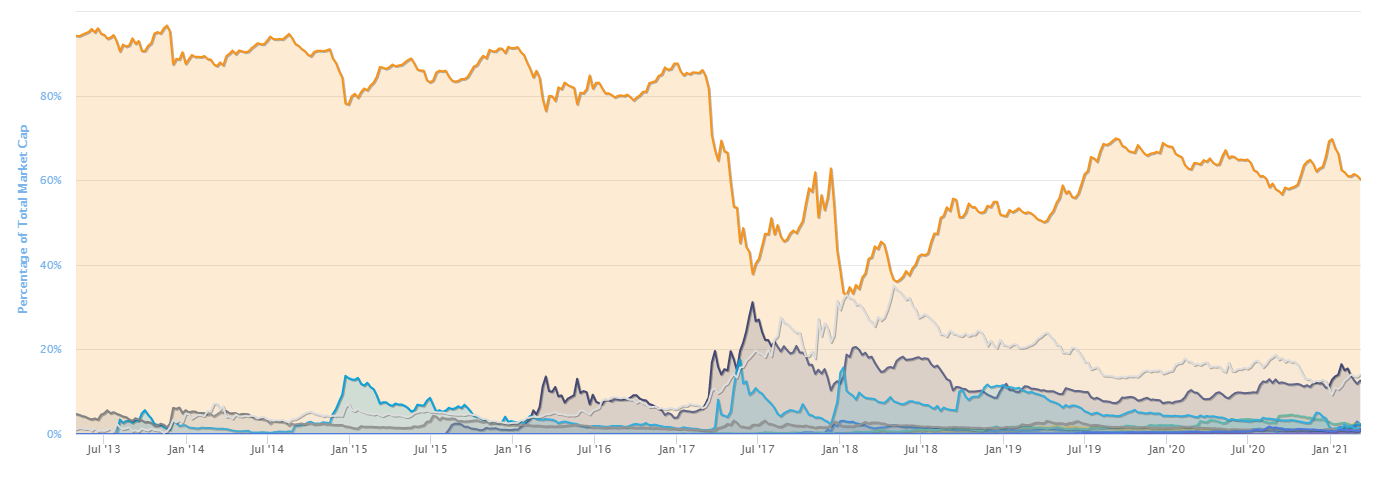

A good indicator of how well altcoins are trading against Bitcoin is the percentage of the total market Bitcoin controls at any given time, otherwise known as Bitcoin Dominance. From this chart, we can see that Bitcoin maintained a more than 80% dominance in the market until 2017, when altcoins began to grow. Bitcoin saw its dominance fall to as low as 33% before stabilizing around 60% in late 2019. Clearly, Bitcoin has maintained its market dominance throughout the years, but there are times when altcoins come to challenge the industry’s leader for market share.

Source: CoinMarketCap.com

Historically, altcoin bull markets can occur for a variety of reasons:

- Bitcoin – Altcoins tend to trade in tandem with Bitcoin, where altcoins’ price rises and falls alongside the industry’s leader. So, when Bitcoin is in a bull market, chances are altcoins are as well.

- Ethereum – The rise of Ethereum as the industry’s Bitcoin alternative has created another major outlet for altcoin growth. In 2017, Ethereum became the go-to network to launch an ICO, causing it to boom in value. Over the years, hundreds of thousands of tokens have been created on Ethereum, and as the network’s value and functionality have grown, so has the altcoin market.

- News – Announcements of product releases, upgrades, cryptocurrency adoption by large banks, or other positive news can spur investors to flood the altcoin market, thereby raising prices.

- Fraud – It’s unfortunate, but altcoins tend to go parabolic in price because of pump-and-dump schemes and other fraudulent activity. In these cases, the bull run is short-lived and almost always followed by a price decline of equal or greater value.

- FOMO – Retail investors tend to invest in a market that’s already rising for fear of missing out on huge returns. This is a self-fulfilling prophecy where demand quickly increases for altcoins, thereby driving prices up as investors flood the market.

How to Know if We Are in Another Crypto Bull Run

Historical bull runs have been marked by money flowing into the crypto industry and its growing technology. In 2011, Bitcoin was starting to become known in the tech space, and by 2013 it was becoming easier for anyone to buy and sell the digital asset. 2017 marked growth in altcoins and ICOs, which brought even more capital into the industry.

But while historical bull runs have been facilitated by money with relatively unknown origins, the current bull run has been pushed into the mainstream. Important public companies and financial institutions are now jumping on board to the crypto rally, and this movement is driving the bull market even higher. Already in the first few months of the year:

- Tesla purchased $1.5 billion in Bitcoin.

- Square purchased $170 million in Bitcoin.

- Chinese technology company Meitu bought $22.1 million of Ethereum and $17.9 million of Bitcoin.

- Norway-based oil and gas giant Aker formed a unit specifically for investing in

- Bitcoin and setting up mining operations.

- Mastercard announced it would facilitate cryptocurrency payments on its network.

- Uber announced its considering accepting cryptocurrencies as valid forms of payment.

- JPMorgan set a price target of $146,000 for Bitcoin.

This influx of capital into Bitcoin and other cryptocurrencies has sparked the current bull market. It’s unclear how long the bull run will last and how high prices will go, but if historic bull runs are any indication, we are in for one wild ride. Regardless of whether this is another record-shattering bull market or the new business-as-usual, savvy retirement savers can use cryptocurrencies to diversify their nest eggs and gain some exposure to incredible growth potential with a cryptocurrency IRA. Contact BitIRA at (800) 299-1567 today to learn more.