The match was just lit underneath Ether’s (ETH) fuse, and while the coin has yet to skyrocket, experts are predicting that’s about to change – and fast. The launch of the first ETH spot ETFs on July 23 was met with a resounding volume of $120 million in trades in the first 15 minutes, representing half of what the first Bitcoin spot ETFs traded when they launched in January.

Even with a momentous opening day in the ETF realm, ETH remains down after a turbulent month, placing it firmly in the “undervalued” category for many informed traders.

Source: Binance

On the day of the ETF launches, ETH briefly climbed over $3,450, prompting many to look for signs of a bull run. It didn’t materialize, however – at least not yet. “I’m very bullish about crypto and ETFs and believe they will go parabolic in the next few years,” posted crypto investor and influencer Alessa Mutto on X.

ETH has some particular advantages over Bitcoin, particularly since last year’s successful transition to a Proof of Stake (PoS) model over the Proof of Work (PoW) model that Bitcoin continues to utilize. Known to some as the Shanghai hard fork, it helped the coin grow from $2,100 to $4,000 by March 2024 as a result.

A major difference in the new model comes in energy efficiency, as ETH is now 99.95% more energy efficient than it was while using its former model.

The shift to PoS also granted the network improved predictability and ease-of-use for some protocols, making it more appealing for developers. Other minor improvements have been seen in scalability and in processing speeds, although the ETH team is constantly working to move these metrics in a more positive direction.

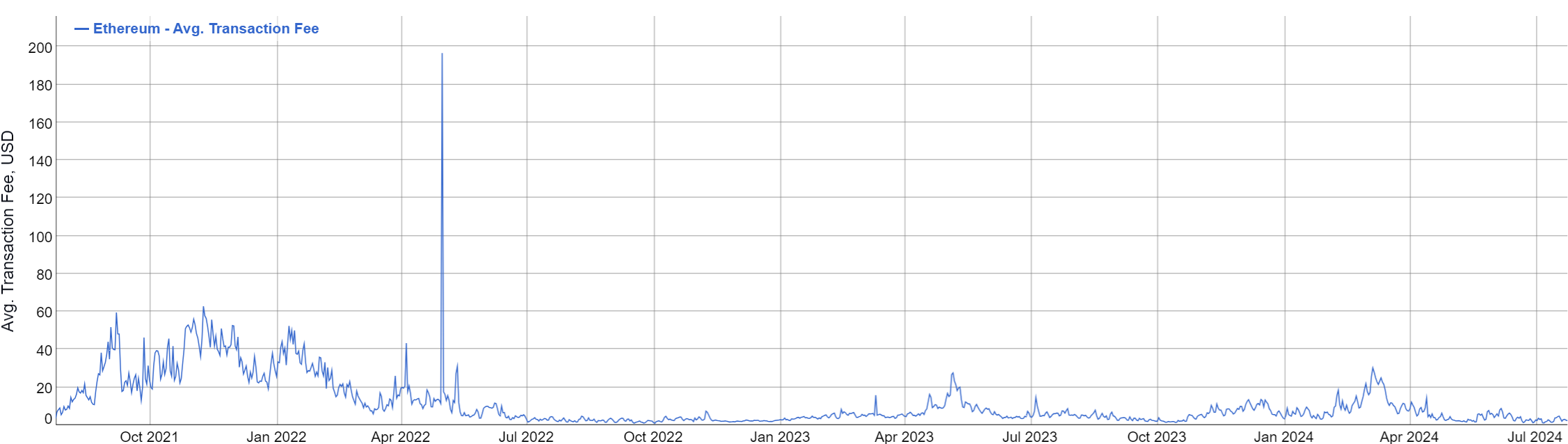

ETH transaction fees have been increasingly more consistent as the network stabilizes and the risk of congestion decreases. Over the past year, the network has seen few major spikes, particularly when compared to the fee fluctuations seen between 2021-22.

Source: BitInfoCharts

In short, ETH has been moving steadily in the right direction through a combination of network improvements and the transition to the new PoS model.

At the same time, however, ETH remains undervalued, in part due to the attention attracted by Bitcoin spot ETFs, per K33 research (PDF). That could change quickly as more and more investors recognize the potential of ETH and tap into it via the newly-launched spot ETFs, which are designed to attract institutional wealth.

While ETH spot ETFs may not reach the staggering heights of Bitcoin spot ETFs – which have become the fastest growing in history in the half year they’ve been active – for the ETH ETFs to attain half the volume that Bitcoin moved in its first full day in just 15 minutes indicates that there are two strong crypto contenders in town. One of them just hasn’t had its big break yet.

Don’t get left behind! Open your digital IRA today.