CoinDesk recently used a Freedom of Information Law request to acquire a snapshot of the famously opaque Tether reserve fund dated March 31, 2021. Media types, especially crypto skeptics, have given Tether no end of fuss over their failure to deliver satisfactory documentation regarding the exact quantity and type of their reserve fund for years now.

All Tether tokens are pegged at 1-to-1 with a matching fiat currency and are backed 100% by Tether’s reserves.

That’s a subtle departure from their original claim, that “tethers were fully backed by cash, at one dollar for every one tether.”

No one was every really sure, though. And that’s led to a lot of FUD, and New York Attorney General James’s 2021 lawsuit fanned the flames.

So where are we at?

When Attorney General Letitia James announced her office’s settlement with Tether in February 2021, she said there had been times in 2017 and 2018 when USDT, Tether’s stablecoin, was not fully backed. The new documents, created six months after the settlement of NYAG’s investigation, neither prove nor disprove that claim.

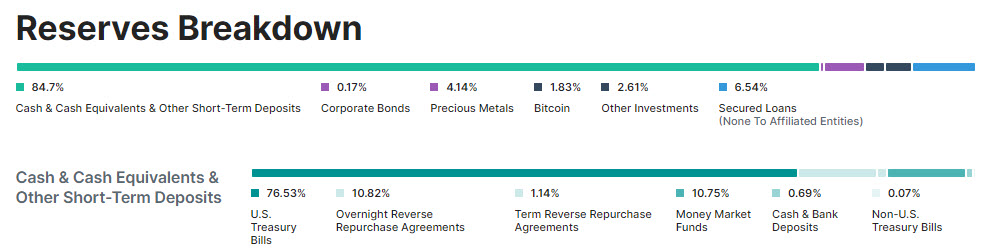

Granted, some things have changed. Tether no longer claims to have $1 on deposit with a bank for every ₮1 in circulation. Tether now publishes a daily reserves report. Today’s snapshot looks like this:

…all very conservative stuff – nothing to raise eyebrows. (The CoinDesk report goes into greater detail regarding specific banks Tether uses, if that sort of thing interests you.)

As far as I’m concerned, there’s a piece missing from this puzzle, though.

USDT is backed by USD – but what’s USD backed by, exactly?

The point of Tether’s reserves is pretty straight-forward, right? If I decide to cash out ₮1, Tether better have a dollar to give me in exchange. Otherwise I’ll get on Twitter to complain and kick off an SVB-style bank run.

So Tether keeps dollars – mostly not bucks in the bank, like civilians do. Tether has certificates of deposit and some bitcoin but mostly what I think of as “cash equivalents” – highly liquid assets easily redeemable on the open market for a fixed quantity of cash. (Sure, about 6% of the reserves are in crypto and precious metals, both more volatile than a savings account – but still.)

I swap my ₮1 for $1.

How, exactly, am I better off?

A century ago, I could’ve taken that $1 into a bank and swapped it for a $1 silver coin. Making a paper asset that’s a claim on something with intrinsic value (like a silver coin) convertible is a big deal. Such an arrangement hampers a government’s ability to create currency out of thin air – they’re constrained by the nation’s supply of gold and silver.

Else you get a run on the bank.

Half a century ago, President Nixon “temporarily” suspended the dollar’s convertibility to gold (citizens hadn’t enjoyed that privilege since the 1930s; it was limited to other governments only). Before that, $1 was defined as 1/35th oz of gold. After that, $1 was defined as a green piece of paper.

Since then, the supply of dollars worldwide grew 2,289% (I’m not kidding – here’s the data).

Gross domestic product, the measure of the nation’s productivity (in other words, real wealth) rose 293% over the same period.

The quantity of money rose about 8x faster than the economy’s ability to create something worth spending that money on.

If the dollar did have anything backing it, today’s dollar would get you about 1/8th as much – in other words, an 87% loss of purchasing power.

But the dollar’s not backed by anything. Its creation is completely unconstrained.

Effective anti-inflation policy

I ran across an interesting tidbit a few weeks ago that offered me some perspective. This is from a review of a biography of Paul Volcker, the legendary chairman of the Federal Reserve who managed to stabilize the U.S. economy during the chaos after the 1971 departure from the gold standard:

Without the money supply anchored by [gold], the only thing ensuring the soundness of the dollar (and, therefore, its role as the world’s reserve currency) was effective anti-inflation policy.

It looks to me like Tether has a much more effective anti-inflation policy than the U.S. dollar. At least Tether has reserves! I’m not entirely certain why its value is pegged to the dollar, honestly – simply matching the dollar’s plummeting purchasing power (down 15% in the last couple years) doesn’t seem like a victory to me.

If Tether at least has an effective anti-inflation policy, it’s already more successful than the dollar itself, isn’t it?

Regardless! The future of money isn’t likely to be stablecoins chained to a sinking fiat currency, nobly going down with the ship. Although stablecoins play a vital role in the crypto ecosystem, they’re probably the least interesting part of it. If you want to learn more about the future of money, and whether it’s a good choice for diversifying your savings, you can learn more here.