A new currency promising apolitical access has hit the world stage. BRICS – the economic powerhouse block of Brazil, Russia, India, China, South America, and its associates – is preparing to launch the Unit, representing the first major decentralized currency developed and launched by nation-states.

The Unit operates on a blockchain network, similar to cryptocurrencies, although its promoters shy away from calling it cryptocurrency outright. Unlike many cryptocurrencies, which are not tethered to a commodity, 40% of the Unit’s value is based on gold. The rest of the token’s value is derived from the currencies of BRICS members, the newest of whom are Iran, Egypt, Ethiopia, and the United Arab Emirates. This is a loose diplomatic alliance of countries, which together represent a sizable portion of the world economy. Through collaboration, they hope to be able to withstand pressure from th United States, and the West in general, but whether this will come to fruition for them is yet to be seen.

The launch of the Unit isn’t a surprise, even though some BRICS members have been downplaying the potential of its existence in recent years. Ever since BRICS formed as a group in 2009, its spoken and unspoken goal has been to reclaim economic power and sovereignty – a path that cannot be fully realized until its members are able to operate outside of the dollar. Many BRICS nations are a vital part of the global oil trade, so moving away from the “petrodollar” would likely be in their long-term financial interest.

As it currently stands, the dollar is involved in approximately 90% of all transactions around the world – which is great for the U.S., but not so great for countries that have their own interests, some of which may be in conflict with Western policies. Having the dollar as the world’s reserve currency is just one of the many ways the U.S. maintains its geopolitical power.

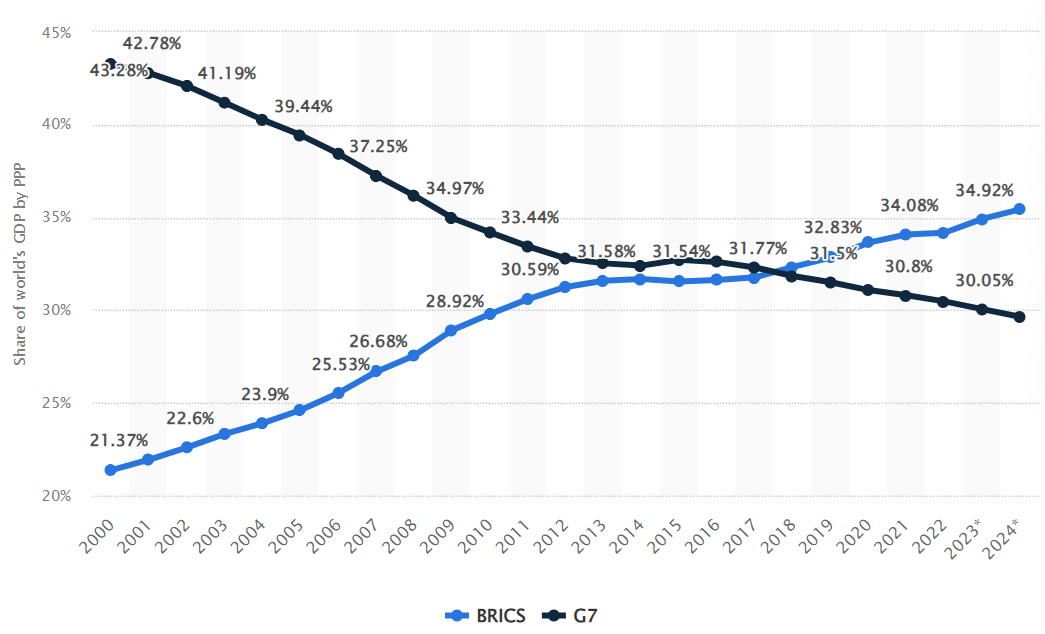

However, BRICS member states comprise a significant portion of the world’s economy, claiming nearly 35% to the G7’s 30%. This gives them a lot of weight to throw around, and it looks like they’re throwing that weight into the blockchain.

Source: Statista

With every member that BRICS adds, that number increases, along with the total amount of investable wealth BRICS possesses. At present, that’s a gigantic $45 trillion. On top of that, BRICS member states are poised to have stronger economic growth than the G7 countries in the coming years.

Put simply, even if the Unit were just based on a basket of its member state currencies, it would be a force to reckon with on the market. Combine that with a foundation based in gold, and the Unit is clearly worth paying attention to.

The cherry on top of these advantages is the Unit’s decentralized nature. By not being tied to any single currency, commodity, or government, the Unit is not bound to political whims, localized catastrophes, or domestic economic issues. That effectively means that holders can comfortably rely on the Unit to hold its value even as fiat currencies struggle to do so in the face of inflation and regional concerns. In some cases, holders can even expect it to gain value, owing to gold’s inverse relationship with inflation and resistance to recessions.

Other cryptocurrencies – from Bitcoin to ETH to alt coins – have similar advantages due to their decentralized nature, making them suitable hedges against inflation and ideal for transacting in apolitical funds. As such, whether it’s through established cryptocurrencies or the newly emerging Unit, decentralized currencies are moving full steam ahead in paving the way to the future of money.