The financial troubles China has been experiencing over the past few years are coming to a head, and with it, the potential for bitcoin as a safe haven during economic distress is being highlighted. Despite bitcoin being illegal in the county, Chinese citizens are buying it up in record amounts as the government is clamping down on investors looking to trade out of Chinese stocks.

It’s not easy buying bitcoin in China, but people are doing it – and it is easy to see why. Bitcoin and other cryptocurrencies have been on a steady upward trend lately, compared with the Chinese stock market, which has been tanking for three years.

Meanwhile, the crypto market in mainland China recorded $86.4 billion in transactions between July 2022 and June 2023, along with $64 billion in Hong Kong during the same timeframe.

One of the factors driving purchasers is the collapse of real estate giant Evergrande, which has been on the horizon for years as the company has been building property after property as it raced to stay ahead of its debts. With no way to pay its debtors, and no demand for its properties, the company has been facing a lawsuit from offshore investor Top Shine Global since 2022.

On January 29, a Hong Kong court finally ordered Evergrande to close its operations, leaving its $300 billion in debt hanging in uncertainty. Creditors are expecting just $0.03 – three cents – on the dollar to be recovered. Worse yet, the Chinese people are the ones holding the bag, as 70% of their assets are effectively wrapped up in the Chinese property market due to the country’s expansionist investment policies.

Stepping back a little farther for a better picture, China’s wealth appears to have peaked in 2021. Since then, it’s lost more than $6.3 trillion in the stock market between the mainland and Hong Kong.

It’s really been a perfect storm for China, between a slow and difficult recovery from Covid and the government’s lockdown requirements, the collapsing property market, and a slow birth rate capping off decades of the “one child” policy. The end result has been financial calamity, and that’s been more than enough to drive Chinese investors to look for alternatives.

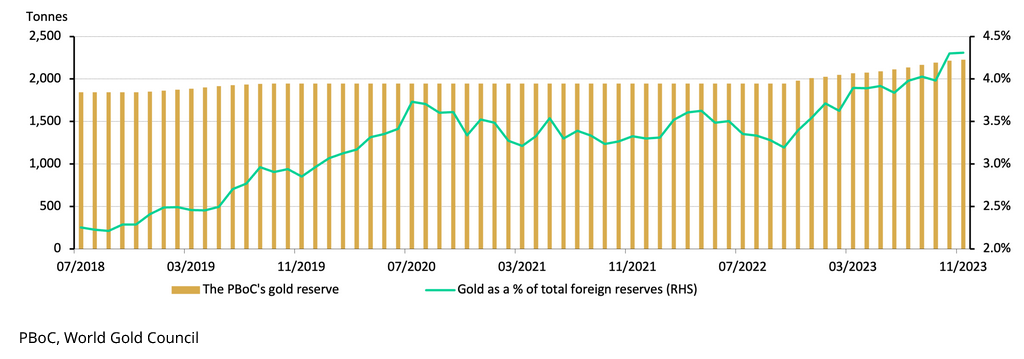

The Chinese government, for its part, has decided on gold as its safe haven. For the past 13 consecutive months, China has been buying gold. As of December last year, the country held 2,226 tonnes of the precious metal.

Source: Gold.org

Gold is considered to be a universal evergreen commodity that serves as a cushion against inflation derived from fiat currencies. Investing and holding gold in the long term is a way to preserve wealth that could otherwise be lost in temperamental markets.

Cryptocurrency, for its part, is emerging on the same footing around the world. Bitcoin in particular is being viewed as a complementary investment option to gold for those looking to diversify their portfolios and protect as much of their assets as possible. Being decentralized and limited in quantity, it’s viewed as significantly more stable than currency controlled by governments with infinite printing potential.

It’s no wonder, then, that Chinese investors are buying into cryptocurrency with enthusiasm despite the workarounds required to do so – and the threat of legal penalties if they’re caught. It’s a perfect illustration of just how valuable alternative assets can be in situations of financial trouble. It also means there’s still a huge untapped market in one of the largest countries on Earth. Imagine the dragon that will be released when the roadblocks to cryptocurrency in China finally collapse.