If you have a significant amount of purchasing power, and you feel strongly that a commodity is going to have a strong return on long term value, what would you do? For most investors, the answer is to buy more of it – and that’s exactly what cryptocurrency whales (holding more than 1,000 Bitcoin) are doing. True, it flies in the face of notoriously wrong Jim Cramer, but when a fool tells you to do something, you should generally do the opposite. I think there was even a Seinfeld episode based on that concept…

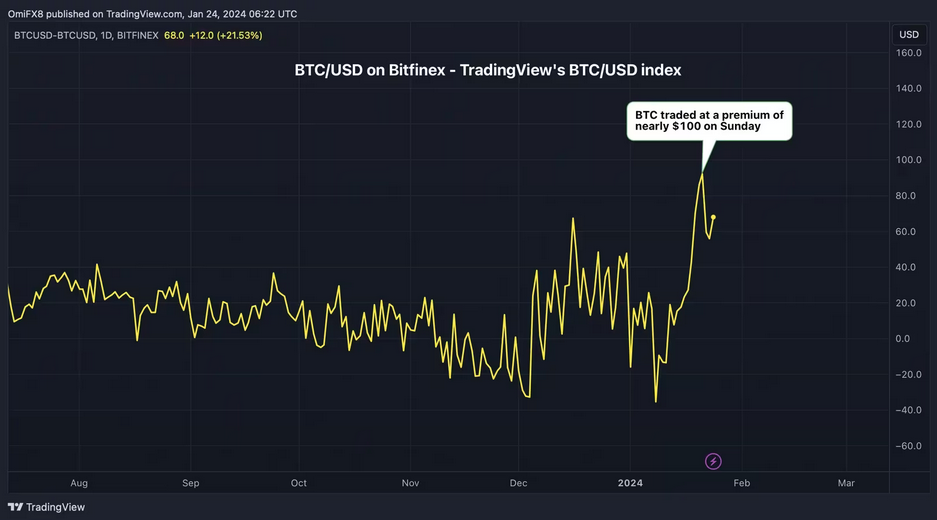

To give a better idea of what we’re talking about, the aforementioned crypto whales appear to be using the Bitcoin lull to buy up a lot of Bitcoin – ostensibly in anticipation of it being worth more at some point (and there are many indicators it will be soon). On Bitfinex, which is one of the leading exchanges for trading volume, some whales have been trading nonstop over the past weekend, leading the platform’s premium on BTC trades to go up to $100 per – quite a bit higher than the global average.

Source: Coindesk

But why pay so much just to make so many trades, again and again? Using the “trade-weighted average price” (TWAP) strategy, investors divide up larger bulk orders to avoid losses due to slippage (caused by unexpected dips in market price that may happen between when an order is made and when it goes through). Having multiple orders minimizes slippage.

More importantly, it illustrates the dominating imperative of whales to buy up BTC as rapidly as possible and to hold it – which is in stark contrast to short term speculators.

Going in the for the long haul

While their size is what most people focus on, the movements and habits of whales can inform the average investor as to how they should be approaching the cryptocurrency market. By considering it to be a long term investment rather than a source of short term profits, there are more gains to be realized.

Short term speculators, or cryptocurrency tourists, tend to get into the market with a goal of capitalizing on public interest and maximizing their immediate returns. While cryptocurrency offers this opportunity in abundance, it’s generally due to it being such a volatile commodity. When it goes low – and it does, in large and small cycles – it presents a good time to enter the market. As soon as it swings higher, crypto tourists may cash in. Or, if it goes lower than they paid for it, they may cash in anyway and carry a bad taste in their mouths for crypto thereafter.

Long term holders, however, have no acute concerns when it comes to the market’s dives and climbs. Instead, they focus on the 3 year, 5 year, and 10 year growth potential of crypto, timeframes that show us clearly that, indeed, “line go up.”

Jim Cramer is always wrong

Let’s close on a brief perspective on why you shouldn’t trust everything people are telling you about crypto, no matter how authoritative they claim to be. In the case of Jim Cramer, when it comes to crypto, he is virtually always wrong.

Cramer said recently, in view of the value of Bitcoin retreating under $40,000, that he didn’t think crypto would “find its footing” and that it has topped out. While its true that Bitcoin has dipped after the boom from the approval of spot Bitcoin ETFs, it’s also true that Cramer said just two months ago that he was wrong about being against Bitcoin and he’s “made a lot of money” from it. It sounds a bit suspicious to us, or, at the very least, like bad advice.

In fact, Cramer’s been wrong enough that the term “the Cramer effect” has been coined, and an actual ETF has been developed that does the opposite of whatever he recommends. In summary, if someone’s giving you advice that appears to be counter to what the market is doing, take notice – and use your own discretion as to whether you should follow it or not.

Photo by Dmitry Osipenko on Unsplash