Shortly after the explosion of cryptocurrency and blockchain technology, NFTs (non-fungible tokens) popped onto the scene in a big way. Most people have likely heard of NFTs, especially considering the many big names and celebrities that got into the early NFT game, but not every really understands what they are. Even people who own NFTs might not really understand what NFTs are all about, and they can even be somewhat polarizing in the cryptocurrency community. Whether you love them, hate them, or know nothing about them, there’s no denying that NFTs are here and playing an active role in the cryptocurrency marketplace. They are an important piece of blockchain technology that adds to the versatility and opportunities available for users.

But what exactly is an NFT, and why do they evoke such strong opinions? More importantly, can they be profitable and how are they affecting the greater crypto industry as a whole? There are a lot of questions surrounding NFTs, so let’s cover everything you need to know to understand the basics.

So What Are They, Exactly?

For most people, their first – and often last – question about NFTs is what, exactly, they are. Short for “non-fungible tokens,” that description is sometimes enough to end the conversation. Non-fungible, however, simply means “unique,” and a token is a token. An NFT, then, is a unique token. Cryptocurrencies are tokens, but typically they are “fungible” tokens, meaning not unique. A single Bitcoin, for example, is a token on the Bitcoin blockchain, and while it can be traced through unique transaction IDs, it is identical to any other Bitcoin. These basic elements on the blockchain are all interchangeable with their peers. A Bitcoin is a Bitcoin is a Bitcoin, but an NFT is special.

What makes NFTs special is that they are granted their unique digital identifier on a blockchain, and their “token” is sometimes implanted into an image. Tie it all together, and an NFT is a unique image traded on a blockchain (they’re not always images, though – see the next section for more on that).

The most famous images associated with NFTs are stylized cartoon monkeys. But why would anyone pay money for an intangible cartoon monkey?

More Than Just Monkeys

It’s important to understand that people who buy NFTs usually aren’t paying for the image itself (artistic prowess behind the cartoon monkeys notwithstanding). Instead, they’re investing in the ownership of both digital and real assets and speculating that the value of the portion they hold will increase.

In that sense, an NFT is akin to a contract or a share. In some cases, NFT purchasers take full ownership (such as when buying an image); in others, they’re buying a share of a company or even real estate. NFTs, in other words, go well beyond digital art. So while some NFTs are simply images and can be traded much like people trade and collect physical artwork, others may be more complex with rules outlying the owner’s role within a bigger organization or granting the owner certain privileges or rights.

In fact, utility is the top reason people go into NFTs, according to a survey from CoinGecko. Almost 75% of NFT purchasers consider the usefulness of a collection or NFT before purchasing it. But what is the usefulness, or utility, of an NFT?

- Virtual access – One of the most common uses of NFT ownership is granting some kind of access in a virtual world. This could be access to an online environment or community, or even access to a game or particular items within a game. It’s essentially like buying a video game license or DLC. The NFT is used to verify ownership, and that ownership can be traded away to others (something you can’t generally do with traditional video game or virtual content licenses).

- Collective ownership – NFTs can also be used like shares in a company. These organizations are typically called DAOs (decentralized autonomous organization) and they operate on a set of rules in which NFT-owners will be able to participate in some degree, just as shareholders of a publicly traded company get to vote on decisions for that company. DAOs may be created for business or community purposes.

- Real world access or rights – Though this is still a somewhat tricky area legally speaking, there have been steps to bring NFT ownership into our physical world by tying certain legal rights to them or granting access to physical spaces and opportunities. Imagine you built a theme park and anyone who owned the right NFTs could get free admission at the gate, or maybe special privileges like getting to skip the lines of rides. There are even attempts to tie deeds on physical real estate to NFTs so that whoever owns the NFT gets to own the real property too, but traditional legal systems from country-to-country make this a difficult thing to implement in practice since deeds are typically recorded at local county courthouses and NFTs can change ownership instantaneously. So it’s important to be wary about any real world promises around NFT ownership because in most cases it’s dependent on a kind of honor system. Don’t expect your local legal system to back you up when you bring your NFT into court as a legal, valid contract.

- Art and fashion – A lot of NFTs are collected and traded like people would collect and trade physical art, but there can also be additional rights and privileges built into this beyond simple ownership of the item. This typically applies in fashion, as you may see people wearing or even selling clothing with their NFTs on them. This takes the concept of art collecting to the next level by allowing the owner to have some degree of copyright on the artwork itself. Imagine if you purchased a physical Warhol painting and that meant you were allowed to make reprints and sell merchandise of it. Some digital artists also appreciate NFTs for the ability to earn commission on trades, so as their artwork gains in popularity and spreads online, they get a piece of every transaction which could make being an artist more tenable in today’s world.

- Crowdfunding – NFTs have been an effective way to crowdfund for projects and raise money for charitable causes. By creating an NFT collection dedicated to a shared goal, supporters are able to give money through purchasing NFTs. Even if the NFT is ultimately useless and serves as little more than a receipt, it’s at least a more interesting and creative receipt than an actual receipt would be. In most cases, NFTs for this purpose will offer some kind of special recognition in the project itself, similar to how a Kickstarter project might function.

Since ownership is tied into the blockchain, it’s effectively tamperproof, making NFTs a go-to choice for those wishing to undeniably possess an asset. It’s enough to fuel more than 10,000 NFT transactions per day. But keep in mind this is still a new area in modern law, and the law may differ considerably between different jurisdictions. That isn’t a reason to call the whole thing malarky, though. You may wonder if you can really “possess” something that is intangible? Well, Disney’s lawyers sure know how valuable their copyrights and trademarks are, so clearly something doesn’t have to be tangible in order to have real value. What’s important is ownership.

Who is buying NFTs?

NFTs are out there, and people are investing in them, that much is clear. Let’s take a quick look at the NFT marketplace today to get an idea of who’s involved in it, and to what degree.

Millennials are the private individuals who are primarily driving the purchase of NFTs, with that generation being three times more likely than their Gen Z successors to own one. Similarly, owners are male rather than female at a ratio of 3:1.

Beyond being male and millennial, NFT owners are more likely to live in China and Singapore than anywhere else, with Venezuela coming in third place. The United States, for its part, isn’t in the top ten for individual ownership. However, some big celebrities around the world have participated in the NFT craze, including Eminem, Justin Bieber and Madonna, to name a few. Donald Trump also recently released a series of NFTs which were quickly bought up by his supporters and potential speculators.

Larger institutions and companies have been reluctant to get into the NFT business, though. Some jumped on board with what were mostly short-lived marketing stunts, but true institutional adoption has yet to take off.

NFT movers and shakers

At the very pinnacle of NFT performance is “The Merge,” a legendary collection of art sold in December 2021 for $91.8 million; it was fractioned out in 312,686 pieces to 28,000 owners.

Most people aren’t involved with NFTs at that level, of course. Some prefer to buy from specific collections, such as the colorful but dystopic 0N1 Force universe. The average 0N1 Force NFT sells for just over $2,000.

Or there’s the Axie Infinity universe, which lets players play an online Pokemon-style game using digital pets called Axies – each of which is a purchasable NFT. It’s the most popular NFT-based game out there, clearing more than $4 billion in sales by 2022.

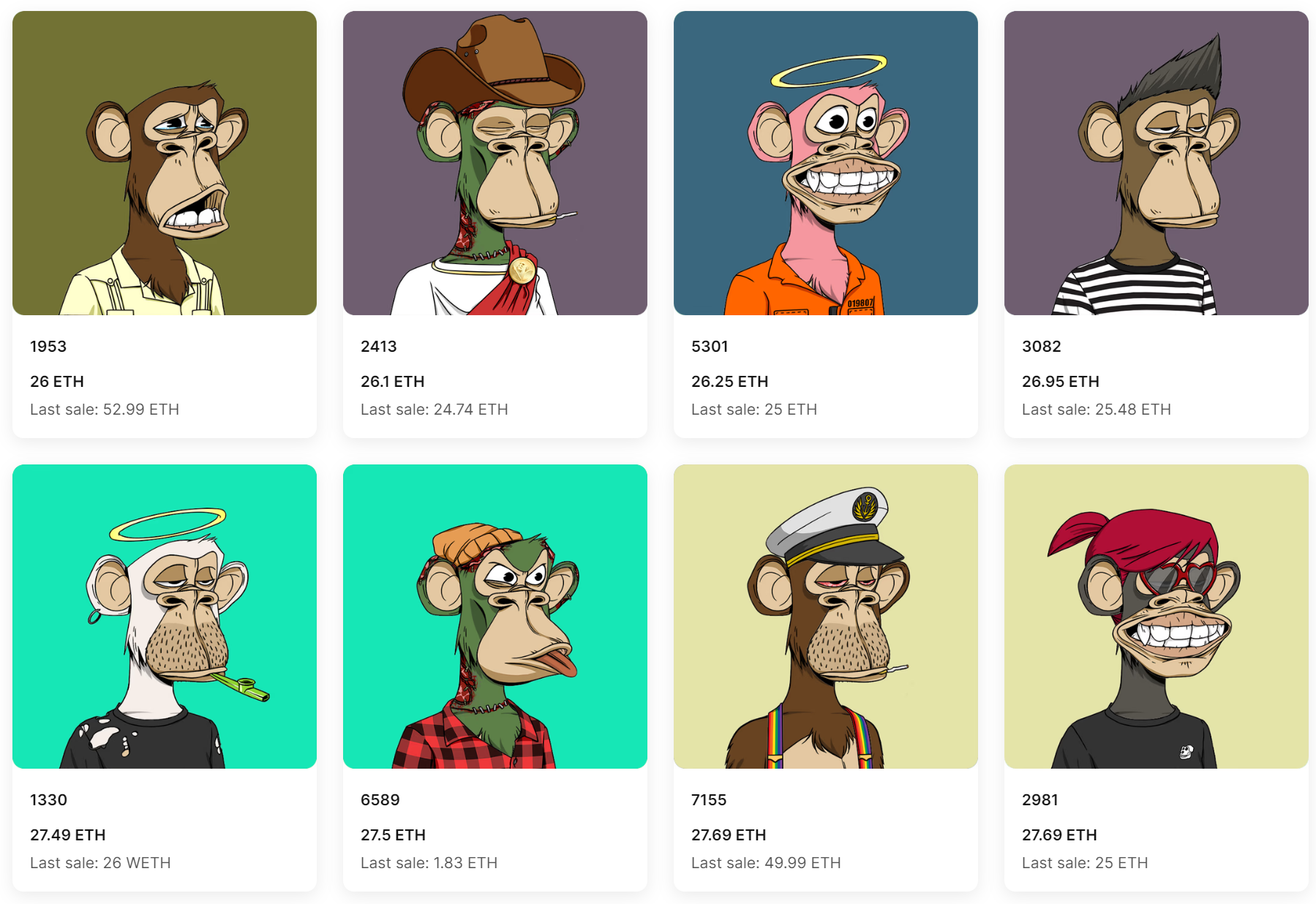

And of course we can’t forget the Bored Ape Yacht Club – being the infamous collection of cartoon monkeys we referenced earlier, and probably what comes to mind when most people think of an NFT. It’s still one of the most popular NFT series, with almost 350 sold between January 12-19 for an average value of $61,000 each.

Clearly, there’s an NFT for almost everybody.

Where to buy (and sell) NFTs

When it comes to where to buy and sell NFTs, there are a few solid options to choose from. OpenSea is the most popular marketplace by far, with a volume of more than $14.5 billion and almost 1.5 million traders using the platform. The average price of an NFT sold on OpenSea is $939.

Magic Eden is the runner up marketplace hosting a variety of designs. Its volume of NFTs stands at just over $600 million, with 305,000 users paying around $309 per NFT.

The afore-mentioned Axie Infinity serves as its own contained NFT marketplace, fueling the gamers that enjoy it with an NFT volume of just under $4 billion. More than 1.6 million traders utilize the service, paying an average price of around $216 per axie.

Other marketplaces follow a similar trend as the Axie Infinity model, including the CryptoPunks marketplace (with an impressive volume of $2.4 billion) and NBA Top Shot, coming in with a volume of $800 million. Both are dedicated to their particular series rather than offering a range of NFT designs.

NFTs as Investments

At this point, it’s easy to see that NFTs are special – but that’s true not just in the way that each is unique, or that they prevent an unmatched method of demonstrating asset ownership. NFTs are also special in the sense that they require specific blockchains that are capable of accommodating them.

To the end user, that means that most NFTs are traded on the Ethereum blockchain network. Bitcoin’s existing blockchain network can’t incorporate NFTs; however, Bitcoin has worked around this by creating Bitcoin ordinals. Investors holding Bitcoin who want to get into the NFT game can either go through a third party system (such as Counterparty or Stacks) to make their purchase or focus only on Bitcoin-native ordinals. So essentially NFTs aren’t something inherent to the blockchain, but rather a new and innovative way that blockchain technology can be used.

Reaching a peak of almost two million wallets actively trading NFTs in late 2021, the NFT phenomenon is one that shouldn’t be ignored by casual investors. With that said, the number of people actively trading has gone down precipitously since then as the market has thinned to those who are fully committed to it. What that ultimately means is that, for one reason or another, most people are not getting into NFTs right now. It remains a growing market, however, with some firms predicting that 2024 will add close to $10 billion to its value. In other words, the people who are into it are really into it.

For the rest of the cryptocurrency industry, including those who invest in Bitcoin as part of a tax-advantaged IRA or who own crypto outright, the impact of NFTs will not come from trading them – but from the added level of interest that NFTs bring to crypto in general. Whenever more people look for ways to demonstrate undeniable ownership in both real and digital goods, or for novel investment opportunities, NFTs will be there for them, and the value of the cryptocurrency used for the transaction will increase as a result. If you hold Ethereum, for example, you could be benefiting from NFTs while never even owning any yourself.