2023 Sets the Stage for 2024’s Crypto Super Cycle

In the rearview mirror, 2023 will be noted as a milestone year for cryptocurrency, not just for its banner surges that led to Bitcoin being up 172%, but for laying fundamental foundations in the eyes of investors to stabilize the industry going forward. Yes, there have been legal issues and concerns around regulation, but after the dust settled and the path ahead has become clearer, the stage is optimally set for 2024 to be the biggest crypto year on record.

A Look Back at 2023’s Crypto Highlights

Let’s rewind. The year started modestly with Bitcoin at about $16,500, having been diminished following the 2022 collapse of fraudulent firm FTX. The trial unfolded over the past year, bringing the bad behavior of the company to light. Illustrating that FTX was not a good or reputable actor and was facing justice for it helped investors feel more comfortable in the crypto industry, and the market started heading up slowly.

The SEC almost threw a wrench in the works when it levied legal charges against major crypto wallet Coinbase for allegedly operating without proper registration while simultaneously going after Binance for its illegal operations. In the case of the latter, Binance has ample instances of acting outside the law, but the same is not true for Coinbase.

Coinbase has since pushed back, arguing that its contracts shouldn’t be considered securities and that the SEC is overreaching, and members of Congress have summarily agreed. Whether or not Coinbase succeeds in having its charges dismissed, the pushback against the SEC for coming after the company has been enough to indicate to investors that the industry and legislators are united in wanting to establish clear and fair regulations.

The promise of impending regulations is one factor that helped the crypto market inch up in 2023, but it’s another major legitimizing event in the works that investors have been going all in on: the prospective approval of a Bitcoin ETF.

When BlackRock – the largest financial firm in the world – submitted an application for a Bitcoin ETF to the SEC in June, everyone took notice. BlackRock’s approval rate for such applications is close to 100%, and the consensus is that the company wouldn’t have submitted it unless it knew it was very likely to pass. With the passage of a Bitcoin ETF, the marketplace will be opening to investors across the board – and crypto’s credibility will further increase.

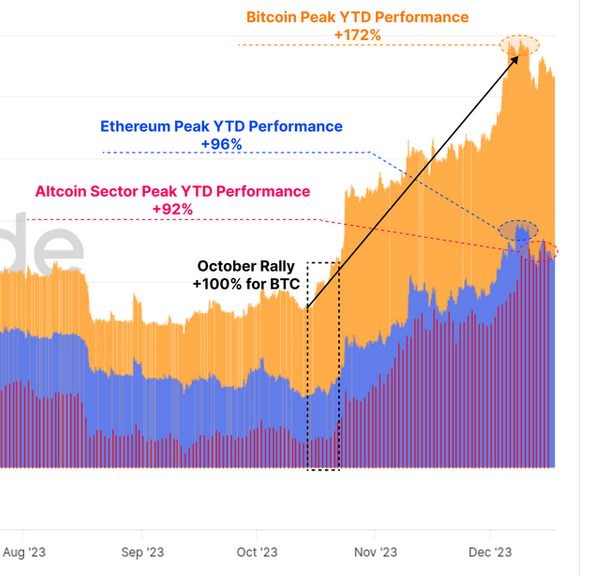

Source: Glassnode

By October, the settling of the industry’s legal perils, regulations being in the works, and BlackRock’s ETF bid combined to help set momentum to propel Bitcoin, Ethereum, and alt coins to new heights for the year. Importantly, a major psychological threshold – the $30,000 price point for Bitcoin, or where it was prior to FTX’s collapse – was crossed, indicating recovery is well underway.

2024’s “Super Cycle”

Most of the promise of 2023 is technically unrealized, as investors are continuing to anticipate the unfolding of the events it set into motion. When the Bitcoin ETF is approved, and when fair regulations are outlined by Congress, the market will respond with intense enthusiasm. But that’s only part of the picture for 2024, when another major event will add rocket fuel to the crypto industry: Bitcoin is poised to halve in April.

Traditionally, the halving of Bitcoin has led to a bull market each time it’s happened. This time, the market has settled to the point that 76.1% of BTC holdings are held by long-term investors, leaving the short-term holder supply at all-time low. The effect of the Bitcoin halving is a reduction in supply – meaning that the already-low supply will be further limited, causing prices to go up even further.

It’s enough for Shivam Thakral, CEO of BuyUcoin to declare a “crypto super cycle” for 2024. “The mega events like Bitcoin Halving and ETF approval anticipation will play a key role in driving the momentum of crypto assets,” Thakral writes. “Simultaneously, clarity on the regulatory front will attract institutional giants to start their digital asset journey.”

What could these signs amount to? According to Standard Chartered Bank, we’ll be looking at a Bitcoin value by the end of 2024 of $100,000.

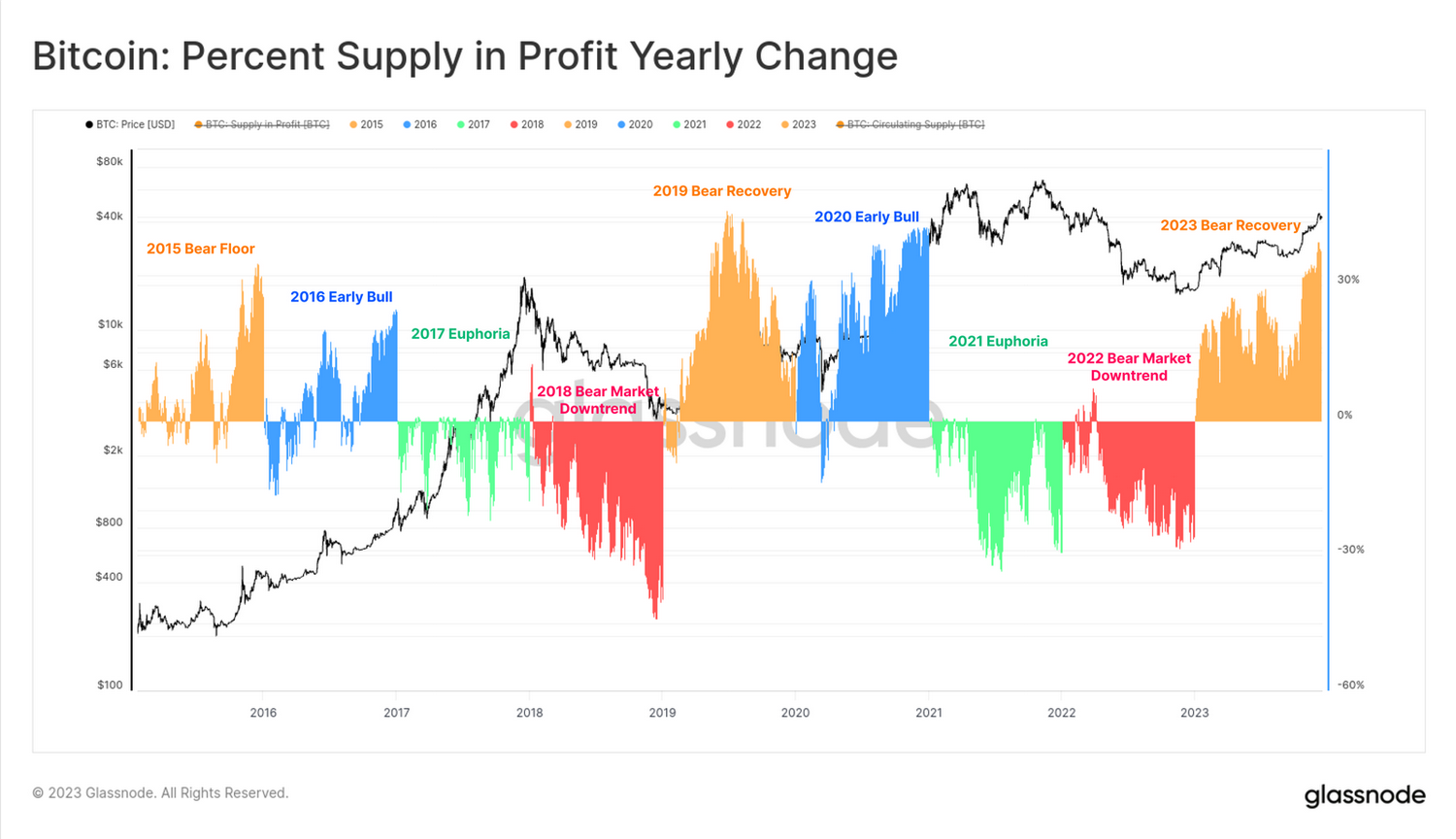

Taking a step back and looking at the longer cycles of the crypto market, Glassnode sees a four-year pattern, with the market now poised to enter the “Euphoria Bull” stage.

Source: Glassnode

The signs pointing in favor of the crypto industry are numerous, and some of them are so big they’re hard to ignore. For investors, it’s easy to see why 2024 is going to be one for the books.