While winter is here in the northern hemisphere, the signs are abundant that we’ve reached the end of the crypto winter. Symbolized by cool attitudes from investors toward cryptocurrency, the period extended for 13 months as the industry hit repeated stumbling blocks. With a staggering rush at the end of 2023, however, investors are making it clear that they’re hot on cryptocurrency – and there are many reasons why.

Before we dig into it, let’s take a moment and reflect on the most recent crypto winter and how far we’ve come. Defined simply as an extended time period when cryptocurrency prices generally move lower and experience decreased trading volume, the last crypto winter began on the heels of November 2021.

Winter sets in

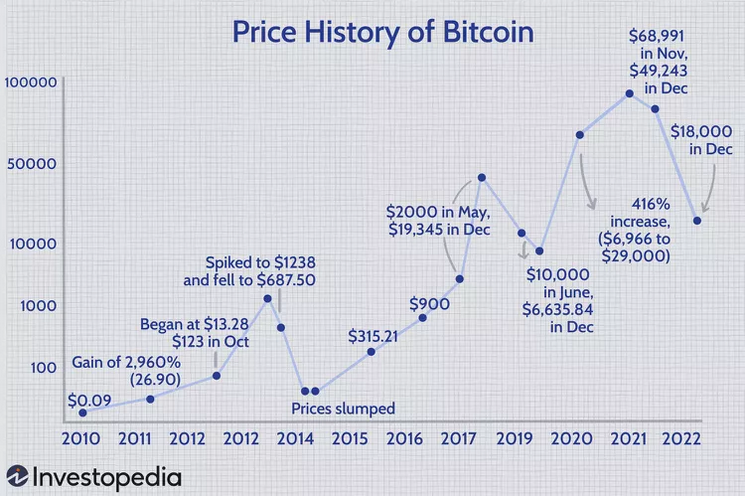

Bitcoin, being the figurehead crypto coin, was valued at $68,991 that month (close to its peak for the past cycle). Then the US interest rate jumped to 6.8%, up from 1.4% earlier that year. Bitcoin’s value fell almost $20,000 by the following month.

In 2022, multiple cryptocurrencies collapsed, including Luna and TerraUSD, causing investors to lose billions. It didn’t help in November when cryptocurrency exchange FTX ran into stiff legal trouble and CEO Sam Bankman-Fried soon found himself facing seven criminal charges.

By December 2022, Bitcoin’s value bottomed out at about $16,000 as the depth of the woeful winter was realized.

Fortunately, the crypto winter started to thaw through 2023, as Friedman was brought to justice and more and more investors began turning to crypto as a buffer against inflation. Small investors, large investors, corporations, and even nations declared their interest in cryptocurrencies, with Bitcoin continuing to be the favored option.

Spring arrives

The heat turned up in earnest in October following several major turning points in the industry, including BlackRock – the world’s largest financial firm – submitting a Bitcoin ETF for approval to the SEC. While it hasn’t been approved yet, most believe it will happen soon, based on BlackRock’s near-bulletproof submission record.

With countries around the world laying the framework for crypto regulation, and Bitcoin poised to halve in April 2024 – which has traditionally triggered a boom – and it’s easy to see how brightly the sun is shining on the crypto industry. Using Bitcoin as our example, it reached over $42,000 in December 2023, having recovered nearly all of the last two year’s losses and having done so on a rock solid foundation ready for future growth.

Just like the regular seasons, the crypto industry experiences cycles of winters and summers. That is to say, winters may come and drive the value of cryptocurrencies down, but summers will return to lift them back up higher than before, as this chart through 2022 illustrates. Once the industry becomes fully regulated and stabilizes through its growth pains, the winters will diminish until disappearing entirely.

Source: Investopedia

How high will the next crypto summer take us? Some, such as Standard Chartered Bank, are speculating that we’ll see $120,000 for Bitcoin by the end of 2024. Whether or not that’s the case, investors are warmly welcoming the end of the chill on crypto.