As one of the most popular investment vehicles in the U.S., ETFs are only gaining steam – particularly with the recent launch of spot Bitcoin ETFs. But what exactly are cryptocurrency ETFs, and how can they benefit investors? In this guide, we’ll look at the two types of cryptocurrency ETFs – futures and spot – and outline the pros and cons of both. Keep in mind that cryptocurrency ETFs aren’t the only way to hold, or even to invest in, cryptocurrencies. People can hold crypto in their own virtual wallets, or even use retirement savings to invest in a cryptocurrency IRA which comes with tax advantages.

First, a quick primer on ETFs themselves. Short for Exchange-Traded Funds, ETFs are portfolios of indexes of stocks and securities that are traded on exchanges (as the name suggests). In practice, ETFs are a low cost, low risk way for investors to tap into the market, making them highly preferred by individual investors looking to avoid high fees. First introduced in 1993, they’ve become one of the most popular methods of investment in today’s market.

With that out of the way, let’s move on to the first type of cryptocurrency ETFs approved in the U.S.: futures.

Cryptocurrency Futures ETFs: What you need to know

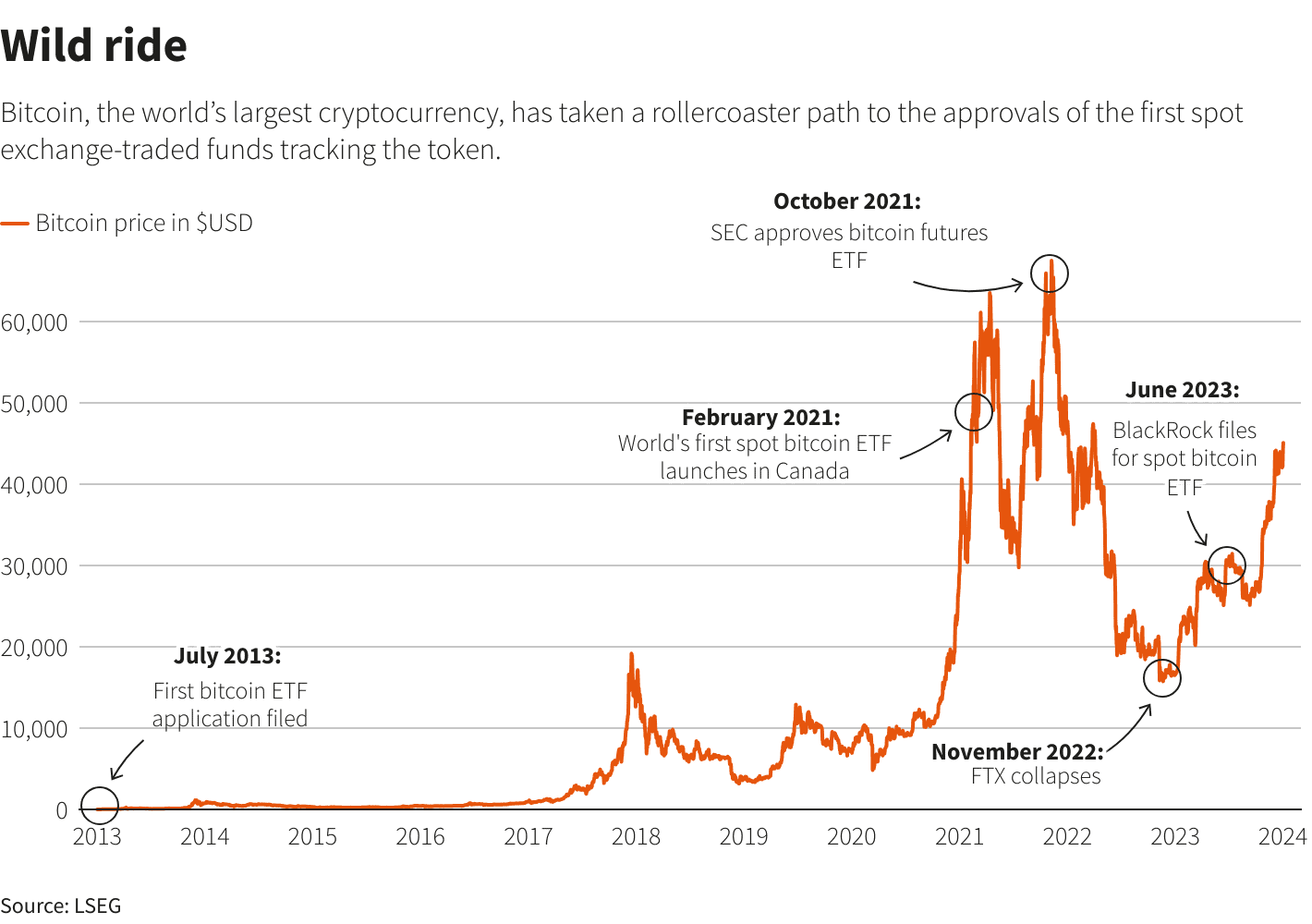

Despite being around as an investment vehicle since 1993, it’s taken a while for the first cryptocurrency-based ETFs to make it onto the scene. That’s not without trying – the first application for a Bitcoin ETF was made to the Securities & Exchange Commission way back in July 2013.

After years of that application being modified again and again, and other applications coming in, the SEC finally relented in October 2021 – approving the first Bitcoin futures ETF in the U.S.

Unlike some ETFs, futures work by enabling investors to form contracts that state they will buy or sell Bitcoin in the future at a specified price. They don’t involve direct ownership, and can be cumbersome in the sense that the contracts themselves can come with added fees, which takes away from profits. Since they’re not directly tied to Bitcoin’s value but are instead tied to its assumed future value, they don’t reflect the live market. For these reasons, futures ETFs aren’t as preferred by investors.

All the same, Bitcoin futures ETFs have become an active part of the marketplace, with investors falling into one of two camps: those who hold primarily Bitcoin futures ETFs and no other futures, and those who hold an equivalent mixture of Bitcoin, energy, precious metals, and equity index futures. In other words, people who buy Bitcoin futures are either in it for just the Bitcoin or they believe in balanced diversification across commodities.

Perhaps more importantly to the long-term market, the opening of Bitcoin futures ETFs paved the way for the approval of Bitcoin spot ETFs, which finally took place in January 2024.

Crypto Spot ETFs: The hot new option

Clearly, the approval of Bitcoin ETFs in general has been a long time coming – but the approval of Bitcoin spot ETFs in particular is a milestone that many investors have been waiting for. The reasons are numerous.

Unlike Bitcoin futures ETFs, spot ETFs are directly tied to the live market in their value. That’s because investing in a Bitcoin spot ETF entails holding actual Bitcoin in a fund – although it’s different from taking direct possession by buying the cryptocurrency yourself.

How so? Investing in a Bitcoin spot ETF is as simple as making a purchase through a brokerage account, a process that investors are highly familiar with. Purchasing cryptocurrency outright involves signing up for a cryptocurrency wallet and a cryptocurrency exchange, and connecting one or both of them to your bank account.

Cryptocurrency wallets and exchanges have had their share of bad publicity stemming from weak security systems, hacking incidents, theft, and corruption, making some investors wary of getting directly involved with them. That’s why Bitcoin spot ETFs are so important: they allow everyday investors to get into Bitcoin (and other cryptocurrencies as their spot ETFs become available) without exposing themselves to unnecessary risk.

That’s similar to the SEC’s argument on why it held back for so long on approving Bitcoin spot ETFs – the market is poorly regulated in the U.S., and the potential for risk was too high, the agency believed. That argument didn’t hold water when Grayscale sued the SEC over initially failing to approve its application, finally opening the doors to a trading vehicle crypto enthusiasts have been waiting a decade for.

Futures or spot? Making the choice

So which ETF type is better to invest in? Most investors have been awaiting spot ETFs due to their value being directly tied to the value of Bitcoin, as well as the ease of management and lack of additional fees for rolling over futures contracts. With that said, if Bitcoin futures are the only available option for investment for whatever reason, they still represent a way to be exposed to the market in a more regulated fashion than owning the currency yourself.

Investing in a Bitcoin spot ETF will be the preferred method of accessing the cryptocurrency market for many investors over both futures ETFs and outright ownership, particularly if those investors are concerned about regulation and risk.

Benefits for everyone

If the Bitcoin market continues to go up – and many market analysts are pointing to the approval of the spot ETFs as direct evidence that they will – then any form of investment is a good one. There’s no guarantee in that, of course, as all investments come with risk. For most investors, the choice to get into cryptocurrency is based on a desire to diversify their portfolios and minimize the losses that can come from inflation. With the opening of the Bitcoin spot ETFs, that choice is now much easier to make – and all holders of Bitcoin will benefit from that accessibility as a result.

The success of Bitcoin tends to lead toward success for other cryptocurrencies too. Adoption of blockchain technology drives institutional support which in turn makes adoption easier, fueling a cycle of usage driving prices up. So even if you’re holding other cryptocurrencies, Bitcoin ETFs are probably good news.

Only Bitcoin for Now

Of course, anyone into crypto knows there are a lot more cryptocurrencies out there than just Bitcoin. While Bitcoin is definitely the top dog, several other cryptocurrencies are popular or have particular niche value. Most alt coins are unlikely to be approved by the SEC for their own ETFs in the near future, though. However, Ethereum might be a candidate for a future approval. For now, though, the only cryptocurrency available as part of an EFT is Bitcoin. Investors that want to diversify their crypto holdings will have to look at other options to do so.

Why an ETF when you can hold Bitcoin directly?

There are many reasons people may want an ETF over holding Bitcoin in their own wallet. Either way, the value of your assets is directly tied to the price of Bitcoin. With an ETF you’ll likely be paying management fees, but the trade off is the simplicity and (hopefully) security that comes along with the ETF. When you have big institutional names in the game like BlackRock and Fidelity, you can bet they’re taking security seriously. Assets are likely much safer with a large institution than saved to your personal flash drive you could easily lose, or on your mobile device that could be hacked. Plus, many cryptocurrencies have a large barrier to entry when it comes to technical know-how. This makes it harder for regular people to invest in cryptocurrency, even if they might like to. Though advancements in wallet technology has streamlined a lot of the work and made it easier for people to buy, trade and use crypto, there can still be some hurdles. This is where an ETF can save someone time, and as long as it’s with a reputable company, you can trust they know what they’re doing and won’t accidentally send your Bitcoins into the void thanks to a typo or some other human error.

Because the ETF serves as a kind of “middle man” for your Bitcoin ownership, there are management fees associated with it. You’ll have to decide for yourself if the services and security offered by the particular management company is worth it to you for your financial goals and circumstances.

What about IRAs or retirement accounts?

Though the world has been waiting with anticipation for Bitcoin spot ETFs to get approval, people have long had a good option for investing directly in cryptocurrency. Digital IRAs are a popular method for those interested in long-term investment in cryptocurrency who are looking to diversify their savings for retirement. One of the biggest draws of a cryptocurrency IRA is the tax benefits. Lots of people invest in non-crypto IRAs for those tax benefits, and the same benefits apply when you choose a cryptocurrency one. At BitIRA, we make it easy for anyone to invest in cryptocurrency, and the options aren’t limited to only Bitcoin. We don’t charge a management fee, so the only fees you pay with a digital IRA through BitIRA are transaction fees when crypto is purchased or traded.

Click here to learn more about Digital IRAs or reach out to us to speak to a specialist today.