With Bitcoin spot ETFs taking the financial world by storm – breaking even BlackRock’s anticipated growth projections – and Ethereum ETFs poised to launch next week, it’s clear that this is the year of crypto ETFs. Tucked behind bitcoin and ether, however, there’s a whole new pot of glowing possibilities in the form of Solana. The altcoin is anticipated to be the next ETF, and big investors are taking notice.

Take Cyberphunk, for example, who increased their SOL holdings by a factor of 10 from 6,131 to 63,000 on Tuesday, July 16. That comes with a leap in total value from $1 million to $14 million. It’s also set up to become a Solana validator using its own Solana node, both of which will help support the coin’s efficiency and electronic infrastructure.

“The Solana ecosystem is presenting a lot of interesting opportunities,” Cyberphunk’s CEO, Leah Wald, said to the Block. “There’s a lot of community activity on the chain at the moment and I do believe that a blockchain’s growth can be directly correlated to community and developer activity.”

Solana’s network is currently healthy with no apparent signs of stress or slowdown. Derivatives are pointing toward a bull run, particularly given the coin’s relatively small dip during the recent crypto downturn – indicating the coin has inherent fortitude that will help see it through future bear markets.

Solana offers several unique advantages that are making it attractive to investors. It is the first coin to use a validation method known as Proof of History (PoH), compared to Bitcoin’s Proof of Work (PoW) and Ethereum’s Proof of Stake (PoS). PoH utilizes a repeating hash method to solve blocks, placing transactions and events in chronological order with each pass.

The PoH method is significantly faster than either the PoW or PoS method, coming in with a solve time of 400 milliseconds per block (compared to 10 seconds for Ethereum and 10 minutes for Bitcoin). As a result, Solana is much more energy efficient than either of the dominating coins, coming in with famously low fees as an added bonus.

It’s been sufficient for Solana to gain sufficient popularity among dApp (decentralized applications) developers, leading to everything from DeFi (decentralized finance) and DePIN (decentralized physical infrastructure networks) launches in recent months.

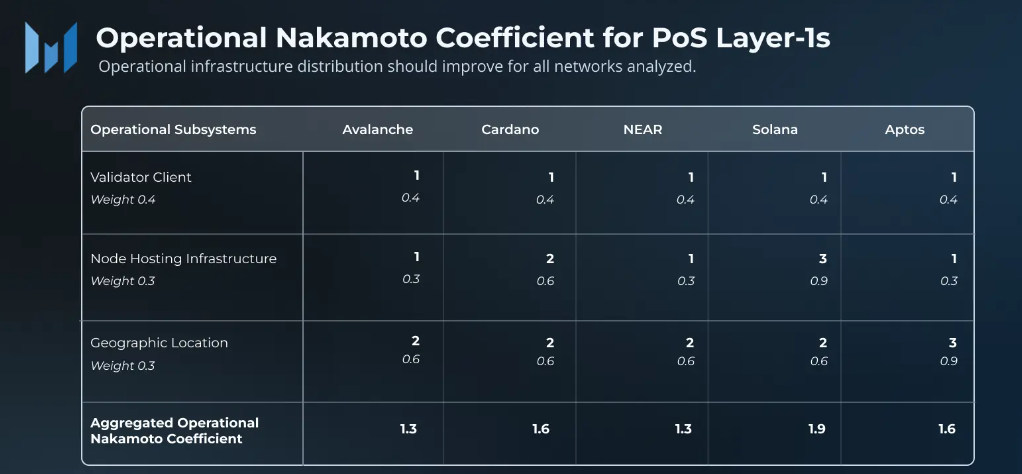

There are some cryptocurrency purists who are reluctant to adopt SOL due to the coin being less decentralized than either Bitcoin or Ethereum and the possibility of one holder having too much power. As more validators are established around the world, however, it is becoming increasingly decentralized – and, in a fact, a recent study from Messari found it to be even more decentralized than its peers.

Source: Messari

With decentralization comes security, and as Solana gains its footing, we can expect to see more and more investors coming on board across the spectrum of financial backgrounds. Also signing on are more and more dApps (decentralized applications), including DeFis (decentralized finance) and DePINs (decentralized physical infrastructure networks.

Photo by Pierre Borthiry – Peiobty on Unsplash