One of the oldest altcoins in the industry is now available for trade through BitIRA, and we’re extremely excited to offer it based on its well-established credentials and potential for moving the needle for the entire cryptocurrency market. When it came out back in 2012, Ripple (XRP) launched with the promise of making global financial transfers easier, and – while it’s been an admittedly rocky startup decade – evidence is abundant that the industry at large is finally ready for Ripple Lab’s product.

The function of XRP is not dissimilar to Bitcoin in that both aim to facilitate financial transactions at the global level by using peer-to-peer technology. Unlike Bitcoin, XRP is specifically focused on enabling cross-border payments – and since it was designed as an alternative to Bitcoin’s slower, more expensive network, it works faster.

Effectively, XRP is designed to be fast, less expensive, and reliable. It’s also carbon-neutral (due to all of its coins being pre-mined) and uses significantly less energy to power its operations.

Furthermore, having Ripple Labs at the helm has enabled direct partnerships with banks, payment providers, and financial institutions around the world – meaning XRP has become an embedded part of the global financial system over the past 10 years. On top of that, its XRP ledger network serves as an intermediary trading system for various other cryptocurrencies, which will become more and more useful as the crypto industry takes off.

While the primary function of XRP is to enable easier global trading, the currency has also been attracting investors who see it as a viable investment due to its potential for appreciation. That’s becoming increasingly the case as Ripple’s legal troubles are passing into the rearview mirror.

The SEC Gets it Wrong

Over the past several years, the SEC has been interfering with the cryptocurrency industry, in part by overstepping its regulatory authority and issuing lawsuits that wind up not having merit.

Ripple Labs was targeted with one such lawsuit in 2020 when they were blindsided by the SEC with the claim that they were illegally trading securities in the form of XRP. For their part, Ripple Labs pushed back against paying a settlement by asserting that the SEC had not notified them they were violating any laws, which the SEC admitted.

Ripple Labs pursued the charge into court. In 2023, Judge Analisa Torres ruled that XRP is not, in fact, a security, a verdict that almost doubled the coin’s value overnight.

The court battles brought other interesting rulings that only further served to cement XRP’s role in the global industry: On March 22, 2021, Judge Sarah Netburn ruled that XRP possesses currency value and utility, differentiating it from cryptocurrencies like Bitcoin and Ether.

A cryptocurrency with inherent value and utility? It’s no wonder investors around the world are excited.

XRP Today

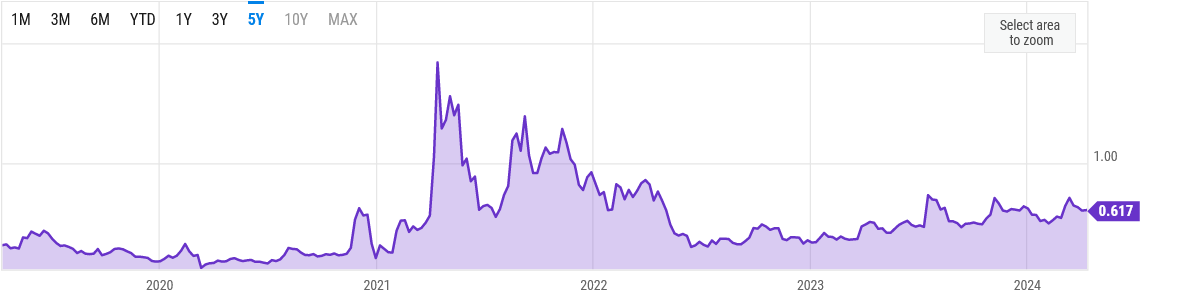

Recognizing that XRP is in the midst of rebounding from its legal embroilment, its price today (0.617) is modest compared to what it was three years ago (1.837). For some investors, that means this is the ideal time to get into the coin (while its price is low), giving plenty of opportunity for the price to grow as XRP regains its value from before the SEC legal attack.

Taking the long view, XRP is on the rise. Just five years ago, the coin was holding around 0.3, and while it’s had some dramatic ups and downs since then, it’s clear that the line is moving up.

Source: Ycharts

There’s a lot behind the value going up. The network of banks that Ripple Labs has partnered with has become known as RippleNet, and it’s becoming one of the first choices for real time international transactions between financial institutions due to being less expensive and faster than alternatives.

Which banks are using it? Santander in the US (160 million customers), Bank of America (69 million customers) Induslnd in India (35 million customers), Siam Commercial Bank in Thailand (17 million customers), Itaú Unibanco in Brazil (55 million customers), and TransferGo in the UK (7 million customers) are just a few examples of banks in the RippleNet already. In total, there are more than 100 banks in the RippleNet, illustrating just how far XRP is able to reach.

It’s not just banks that are able to tap into XRP’s potential. Individuals can get in on the action too and invest directly in XRP. Contact us today to find out how to add XRP to your portfolio as part of your tax-deferred crypto IRA and get on board before the ship sails. Give us a call at (800) 299-1567 or request a free cryptocurrency IRA info kit here.