In a step forward for Ripple and for the cryptocurrency industry in general, XRP has been named as a preferred investment choice by the Basel Committee on Banking Supervision (BCBS). The BCBS confirmed XRP’s standing as the third-largest altcoin, constituting 2% of the total $10.2 billion banks have invested in the sector. Put another way, 19 banks across America, Europe, and other regions have invested approximately $205 million into XRP, according to the BCBS’s findings, and that elevates XRP’s standing for cryptocurrency investors around the world. It also appears to be popular among retail investors, being listed as the 5th most popular cryptocurrency on Coinbase.

It’s a promising development for Ripple, which caught attention in 2020 when the Securities and Exchange Commission (SEC) filed a lawsuit against the company for selling XRP. The SEC alleged that XRP was an unregistered security and therefore the $1.3 billion Ripple had made in sales was in contention.

That lawsuit reached a turning point earlier this year when a federal judge ruled in favor of Ripple and then further ruled that she would not allow an appeal on the SEC’s behalf. The lawsuit is currently in the discovery process, with remedies-related briefs to be filed early in 2024 and a trial to follow – unless the SEC reaches a closed door settlement with Ripple before then.

As a result of the SEC’s legal aggression against Ripple, the company has become something of a figurehead for the cryptocurrency industry and the US’s lack of a clear regulatory framework. With Ripple winning battle after battle on the legal front as it stands against the SEC, investors have been taking notice.

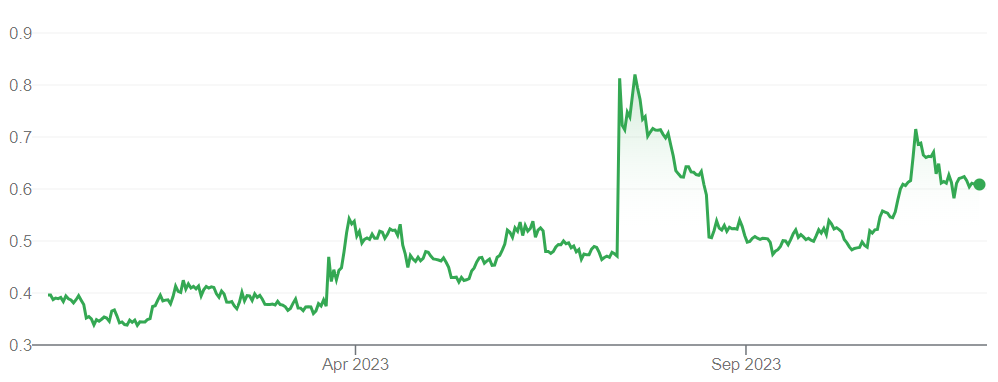

The day the judge came out in favor of Ripple in July, the value of XRP literally doubled. For the year, it’s up almost 80%.

Ripple’s gains are more than just on the legal and financial front. Last month, XRP gained official approval for trading in Dubai, meaning companies and investors can legally purchase and sell XRP in Dubai’s free trade zone. On top of that, the National Bank of Georgia recruited Ripple to help create its central bank cryptocurrency. Ripple, in other words, is making waves in all the right ways.

With clear strides in value this year, it’s easy to see why the 19 banks that were part of the BCBS study have been investing steadily into XRP – and why other smaller investors are following suit, too. Based on Ripple’s value of $0.45 cents per token five years ago, anyone who invested $1,000 back then would have about $1,340 today.

By contrast, anyone who put $1,000 under their bed five years ago would have lost 21.02% of its value due to cumulative inflation and the declining purchasing price of the dollar. Hiding away dollars in any place that doesn’t offer enough gains to offset inflation is not the way to preserve savings for the future.

As an alternative, cryptocurrency is considered a suitable long-term investment to hedge against inflation and diversify portfolios for investors of all sizes (just ask Cathy Wood). Of the cryptocurrency coins out there, Ripple’s XRP is emerging as a viable choice for banks and private investors alike.