In the biggest landslide victory in an Argentinian election since 1973, self-described anarcho-capitalist Javier Milei has been declared the country’s new president. It’s a big deal for Argentina, where residents are struggling with inflation rates in excess of 140%, and it’s a big deal for cryptocurrency, as Milei is not shy about sharing his dismay for central banking.

Milei is so averse to the Argentine central bank – which serves as a representation of economic corruption and financial mismanagement in the country – that closing it is part of his political platform. On top of that, he’s proposing moving away from the peso and calling for the adoption of cryptocurrency and the dollar in its stead.

While the dollar has been having its own troubles lately, leading to talk of dedollarization around the world, it’s true that it is more stable than the peso, and will subsequently help Argentina stabilize over time. It will also tie the country into the geopolitical machinations of the Western world, however, meaning Argentina will have no say or power in the value of the dollar. The dollar, after all, is a clear ambassador of central banking.

That’s why when Milei says “the central bank is a scam,” we don’t hear it as a willingness to jump in with other central banks. Instead, it’s clear support of the decentralization offered by cryptocurrency. “What Bitcoin is representing is the return of money to its original creator, the private sector,” Milei said.

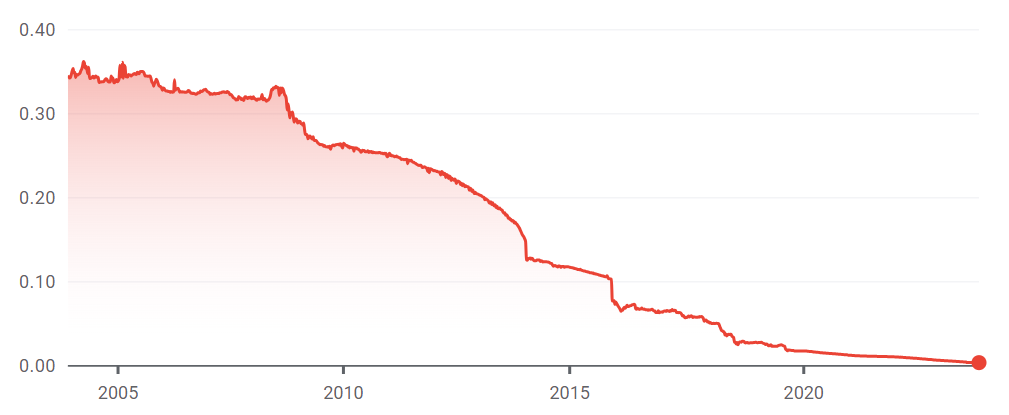

Looking at the peso’s nosedive in value over the past few decades, it’s easy to see why Milei and his fellow Argentinians are looking for something different.

Argentine Peso Value (Source: Google Finance)

With Milei elected by a resounding margin, it’s clear that his supporters are eager to resuscitate the economy using any possible means. It’s important to note, however, that Milei’s vocal support of Bitcoin doesn’t mean that the country is going to follow in the footsteps of El Salvador by making it legal tender. But another world leader this eagerly pro-crypto (and one who realizes the failings of traditional finance) is probably a good thing for institutional adoption of cryptocurrency long-term.

Argentina may not jump full force onto the crypto bandwagon right away, however. For one thing, Milei hasn’t named Bitcoin or any other cryptocurrency to be official tender in the country. For another, Argentina is heavily indebted to the IMF, an organization that has famously tried to limit the usage of cryptocurrency. Just last year, the IMF loaned $45 billion to Argentina – with the condition that it would work to “discourage the use of crypto-currencies” in the country in return.

In other words, Milei may be against central banks – and with reason, given the state of Argentina’s economy – but rushing into the arms of bitcoin will most likely not be high on his agenda.

With that said, however, it is highly unlikely that Milei will do anything to impede the growth of cryptocurrency in Argentina. Residents are gradually buying into bitcoin and other cryptocurrencies as a safe haven against inflation (for the peso and any other fiat currency). As of last year, 27% of Argentinians were buying cryptocurrency regularly, up from 15% the year before. Of all the Latin American countries, Argentina has the fastest adoption rate of cryptocurrency. When traditional finance fails people, as it seems to be doing more often these days, they tend to turn toward crypto.

This all goes to show that cryptocurrency is gaining real traction – not just as a token of decentralization for politicians who are working to restabilize their countries from runaway inflation, but as a currency used daily by people around the world. Whether or not Argentina officially adopts cryptocurrency, its people already are, and Milei’s election means that trend won’t be slowing down anytime soon.

Image by Vox España on Flickr