In recent months, there have been a number of events that have caused short-term volatility in cryptocurrency markets. These have included suggestions of increased regulation around cryptocurrency trading by certain Asian governments and, more simply, short-term traders exiting the market to realize substantial gains.

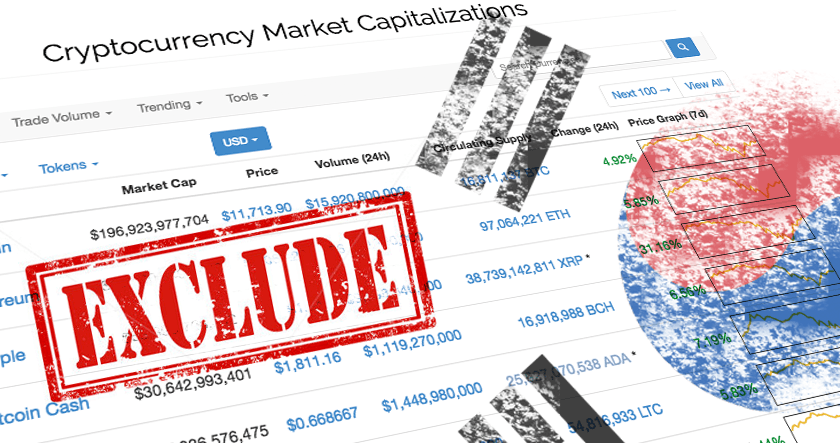

On January 8, it happened yet again, when there was what looked at first to be a substantial selloff. The fall in prices appeared to be driven by a decision taken by CoinMarketCap, a widely used price source for market watchers, to revise the valuation methodology it uses for the coins it provides pricing data for.

This created short-term confusion and concern for traders of cryptocurrency, but in reality, it was a sensible adjustment that could lead to greater long-term price stability.

Why was this decision made?

CoinMarketCap is one of the most widely used price sources for cryptocurrency traders. It is hugely popular, as it provides a weighted average price for nearly all cryptocurrencies. The prices on CoinMarketCap are based on aggregated pricing data from the main global cryptocurrency changes.

At present, there can be a substantial variation in prices between different exchanges, so a resource like CoinMarketCap, which aggregates prices, is a welcome resource.

However, CoinMarketCap recently came to realize that including data from exchanges based in South Korea was causing confusion. The prices on exchanges based there can be up to 30% higher than exchanges based elsewhere in the world. These large differences arise primarily due to foreign exchange controls in South Korea.

It is very difficult for South Korean traders to make large purchases outside of the country. It is even more difficult for international traders to obtain large amounts of Korean Won to make purchases in South Korea due to these restrictions.

These restrictions have resulted in this difference in price between exchanges based in South Korea and elsewhere. It also means that the price differential between exchanges in South Korea is not reflective of the true supply and demand for a particular coin, but in all actuality appear to be due to an anomaly caused by local laws.

Given that the majority of CoinMarketCap’s readership is not based in South Korea and don’t trade on South Korean exchanges, CoinMarketCap felt that it would be beneficial to exclude the price data from exchanges based in South Korea. This would give their readership a more accurate representation of the price they may actually be able to achieve for their cryptocurrency holdings on their local exchanges.

This is why we should view the decision by CoinMarketCap as a good thing, as it offers its readership more reliable pricing data. Ultimately, it’s a sign of the market maturing as the pricing for cryptocurrency assets gets more accurate.

Will there be continued volatility?

While there may be some continued short-term volatility because of this decision and other similar decisions (along with events yet to happen), in the long term these events will have little impact.

Adoption of cryptocurrencies for use in the real economy is continuing. Bitcoin is well established, with many merchants now accepting it as a form of payment. Many companies are even allowing their employees to take their salary in the form of Bitcoin.

Innovation is continuing with cryptocurrencies being developed in ways that could provide valuable services to billions of unbanked people around the world along with much faster transactions for the rest of global business.

In the decades ahead, the growing adoption for day-to-day use will increase the supply of capital that is capable of entering the market. This is not science fiction; the coins are already being used and with wider awareness of the benefits growing all the time, so the long-term future is indeed bright.

There is likely to be a fundamental change in the way capital is moved across the globe driven by this exciting new technology.

While there may be more events on par with what happened with CoinMarketCap that cause difficulties for short-term traders, the development and growth of a fundamental improvement to the global financial system will continue in the decades ahead.

The use and levels of adoption we can see now are only the ‘tip of the iceberg’ for what this technology can deliver. Sometimes it’s difficult to see the forest for the trees, so I always encourage people to take a step back to remind themselves where we are on the adoption curve. Think about the fact that we’re only 12 months into mainstream fascination with this asset, and there is still so much more development to come.

What should I do going forward?

Dips in prices like what we’ve seen in the case with CoinMarketCap should be seen as opportunities rather than a signal to sell. If you see a period of volatility, ask yourself these three questions before you decide what action to take:

- Has the technology underpinning cryptocurrency been shown to be fundamentally flawed?

- Are major corporations continuing to develop Blockchain-based solutions?

- Is there an alternative that’s as widely used and tested, and that is likely to fundamentally change financial services over the next 20 years?

If the answer is no, and your conviction in cryptocurrency is already firm, then you should have no reason to change your viewpoint. Instead, simply view such short-term volatility as inevitable for this growing technology.

While it may seem difficult at times to hold on in the face of very volatile markets, remember that this is the beginning of a financial revolution, and you are potentially getting in on the ground floor.

In the long term, a solution that moves capital faster, cheaper and with greater transparency is sure to be a solid piece of our increasingly technological world.