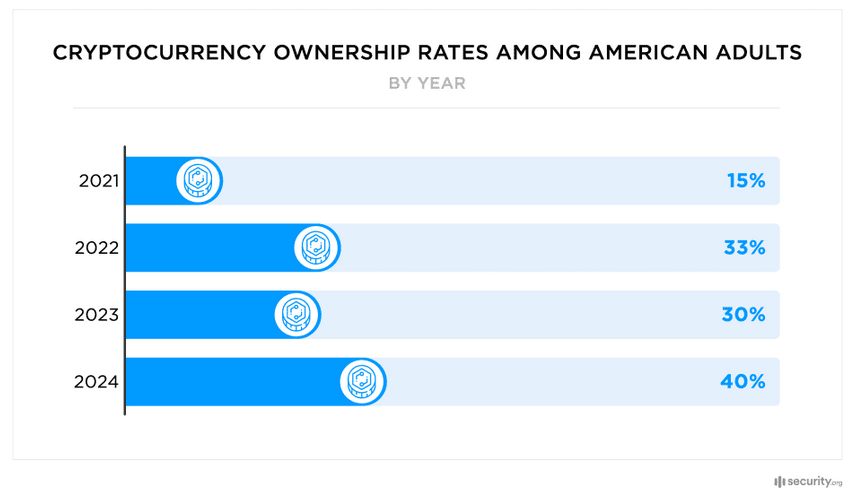

Four out of every ten Americans own cryptocurrency according to a new annual report from Security.org. The report, which has tracked annual cryptocurrency adoption rates and public sentiment since 2021, highlights a number of datapoints that all reflect positively for the growth and overall stabilization of the crypto industry.

The overall adoption rate of 40% is important as it shows a reversal in the trend of divesting in cryptocurrency that we saw from 2022-23.

Source: Security.org

Perhaps more important, however, is the growing awareness of cryptocurrency. While less than half of respondents had any awareness of cryptocurrency in 2021, that number is over 80% today – meaning the wide majority of Americans are aware of cryptocurrency and can thus consider adding it to their wallets or investment portfolios.

Demographically speaking, the most notable shift comes in the form of adoption among women. In 2023, 18% of women owned cryptocurrency. In 2024, that number increased to 29%, representing an 11% gain. The percentage of men owning cryptocurrency increased from 43% to 48% over the same time frame.

When it comes to the ages of cryptocurrency holders, ownership seems to have leveled out equally amongst all ages – with the exception of those over 60, who are much less likely to hold crypto.

All in all, the sentiment toward cryptocurrency appears to be changing. In 2023, 49% of those polled said they would “never” purchase cryptocurrency; in 2024, that number has shrunk to 44% (with a lack of government and financial oversight being the biggest reason cited for not adopting). For non-owners, the release of Bitcoin spot ETFs earlier this year is a major driving factor in potential adoption, with 21% indicating that they are more likely to invest as a result.

The importance of the Bitcoin spot ETFs is significant in driving the adoption for cryptocurrency as most holders of cryptocurrency – 57% – are investors. Having the option of Bitcoin ETFs in place means that more investors will be coming on board, effectively serving as a rising tide that floats all boats.

It’s enough of a win that, regardless of their stance toward personally owning Bitcoin or cryptocurrency, 46% of Americans see the launch of the Bitcoin spot ETFs as having a positive impact on the industry. Current crypto owners are even more enthusiastic, with 56% anticipating continued gains.

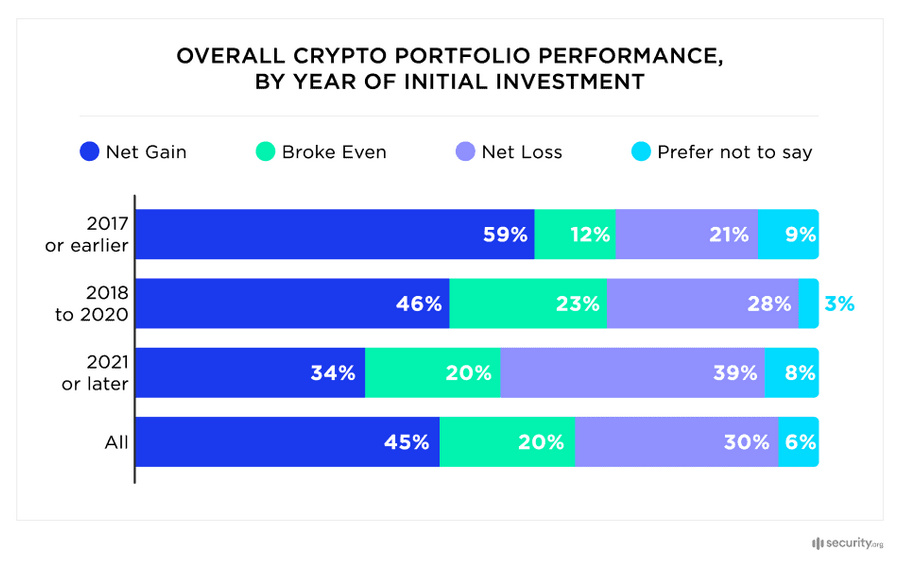

When it comes to investing with crypto, it’s the long time owners who have seen the best performance.

Source: Security.org

This reinforces the need to get in as early as possible and hold on to investments rather than expecting a short term gain.

While investors represent the bulk of crypto owners, others are buying in for different reasons, including to serve as a hedge against inflation, to avoid government regulations, and to make purchases more private. As the U.S. government moves to gain more oversight over financial transactions (see the SEC’s release of CAT in May), more and more Americans will be looking for a way to protect their privacy. At the same time, inflation hasn’t gone away, meaning the need to protect assets will also be a dominating factor in future adoption rates.