Blockchain analysis firm Glassnode has an interesting term for what’s going on in the cryptocurrency space right now: market tourism.

Do they mean a summer trip to El Salvador? Not in the least!

Imagine there are two types of crypto market participants. (This is a gross simplification, but it serves my purpose, so bear with me.)

While Glassnode does give a fairly comprehensive overview, the dynamic is as old as financial markets themselves.

HODLers and tourists

Now, we already know the die-hard crypto investors, the bitcoin maximalists and the dedicated diamond-hands, are collectively known as HODLers. That’s one extreme of the crypto market participants.

Now, at the other end of the crypto market spectrum, we have the tourists. You can think of them as “speculators,” but that’s ungenerous. In fact, the word “tourist” sums it up pretty well! Think about the stereotypical tourist:

- They usually choose destinations haphazardly, without much research.

- They show up in a foreign land, not speaking the language or knowing the customs.

- They insist on having their expectations met, regardless of how unrealistic those expectations might be – and can become downright irrational when reality disappoints them. “No, Sheila, that’s actually how big Big Ben really is.”

- A single bad experience (a rude Parisian waiter, a missed Thai Airways connection) sours them on the entire nation forever.

HODLers buy and hold, often dollar-cost averaging, without much attention on daily, weekly and monthly prices. They believe in long-term growth.

Market tourists buy based on historical prices with a “line go up” mindset – and may sell at any time for any reason. They enter the market as speculators, with the goal of trading their way to profits. They’re also easily discouraged. Without a long-term perspective, all that’s left to look at is short-term price fluctuations. They always have one foot out the door.

These market tourists are at least partially responsible for some of the extraordinary volatility of the last several months. Some no doubt have turned a profit. Many others are desperate to cut losses.

Let’s take a closer look at what we’re calling the crypto market tourists…

Glassnode’s crypto market tourist profile

Glassnode pointed out that the number of addresses holding massive amounts of BTC, ranging between 1,000 to 5,000 tokens and more, is growing significantly. The whales are getting bigger.

That probably means existing HODLers are buying more, and smaller HODLers (baby whales? Dolphins?) are jumping at the chance to grow into whales.

After all, as J.P. Morgan allegedly said during the 1929 market collapse,

In bear markets, stocks return to their rightful owners.

This is unexpected, though: balances of those holding less than 1 BTC are also increasing. (Let’s call them “minnows.”) The crypto market is notching new all-time highs of BTC owners — the latest count had more than 42.3 million addresses.

This tells us HODLers are not doing all the buying. Complete crypto novices must be “buying the dip.” This growth in crypto ownership is especially notable when we remember that the opposite happened during previous crypto bear stretches. In bear markets before this one, minnows would mostly liquidate their holdings, fleeing the market completely (and, possibly, forever).

This is an established phase in bear markets called capitulation.

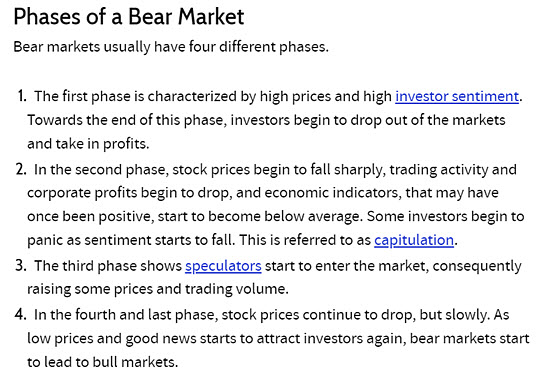

Where does that put us during the typical bear market cycle?

Like I said before, bear markets are a well-established reality in financial markets.

They usually work like this:

In this context, what is the current dip looking like? Some social media pundits have targeted $16,000 as a bottom, saying that we’re seeing lower highs. Though… Wasn’t it just 18 months ago that $13,000 represented an important milestone in a crypto bull run?

As we often remind our readers, perspective and a long-term outlook are some of crypto investors’ best friends. From a more technical perspective, in relative terms, bitcoin has only traded near these levels four times in history.

This was noted by ARK Investment Management, whose CEO highlighted that these kinds of technicals suggest a bottom is nearing. The firm is neutral to positive on the market right now, stating that they aren’t concerned as it weathers a historic storm.

One can see how the last point can be made. It has, for the careful observer, almost become difficult to feel concerned for the crypto market. Even during what could easily be the worst recession in 50 years, the experimental crypto industry is growing. It’s happening even as companies are forced into downsizing due to broader economic conditions.

We’re hitting all-time highs when it comes to the number of addresses holding crypto assets during a time of broad market selloff. That means adoption is actually increasing amid what looks like a rough bear market. But how rough is it, really? Bitcoin is still returning above $20,000 and therefore above the iconic, mindblowing all-time high of $19,200 in 2017.

A quick history lesson really puts things in perspective, doesn’t it?

What’s even more impressive is the resilience of the crypto market with the recent collapses of several notable projects. Prices go up, prices go down – but crypto doesn’t go away. We’re not going to say that it’s not possible to make a bearish case for crypto anymore. But we’ll venture to say it’s becoming more and more challenging, and quite frankly for those with the right perspective and risk tolerance, there might not be a better opportunity to enter the market than right now.

No tourists, though. Sometimes they get motion sick.