Is this the year cryptocurrency makes its big comeback? Signs are pointing strongly in that direction as analysts look beyond the frenzy of attention generated by the approval of the Bitcoin spot ETFs and to the momentum established by regulatory gains and institutional adoption last year. Tellingly, public interest in Bitcoin – based on Google Trends – is heading to its highest point in two years, signaling that, yes, crypto is back.

“The funeral dirge is over,” financier and crypto advocate Anthony Scaramucci said in a Davos interview. “This is a Lazarus year.” High in the Swiss Alps, finance heavyweights are toasting the recent ETF approvals and what it means for cryptocurrency adoptions. Traditional finance is poised to jump into the crypto game big, and it’s made crypto the talk of the town at Davos along with other cutting edge technologies such as AI.

While there’s no denying that the impact of the now-approved Bitcoin ETFs is huge, it’s only a small part of the puzzle that makes up cryptocurrency’s public acceptance. Let’s look at the other factors moving the needle for the industry.

Last year represented a turning point as FTX’s fallen CEO Sam Bankman-Fried faced justice for the company’s corrupted practices and Binance was similarly brought to heel. True, there were a few stumbling blocks mixed in with that fiasco – including the SEC coming after Coinbase for allegedly making illegal trades – but seeing bad actors reigned in has helped restore the public’s trust in legitimate cryptocurrency outlets.

It’s an important step along the way to regulation in the US, something that Congress is fervently attempting to roll out as the industry gains more and more steam. Countries around the world have been actively developing their regulatory framework for cryptocurrency, with more than 40 countries doing so just last year. In February, the IMF released recommendations for countries who are developing regulations around cryptocurrency, recognizing the need for a universal approach.

What difference does a little regulation make? The number of merchants around the world who accept Bitcoin as tender tripled in 2023, with Central and South America and the Philippines seeing the most growth. By the end of the year, more than 6,000 merchants officially signed on.

Being able to pay in Bitcoin – especially in countries where the fiat tender is experiencing inflation – is a big motivator for the public in adopting cryptocurrency in general. For people living in countries such as El Salvador, which named Bitcoin as legal tender, it’s a no-brainer.

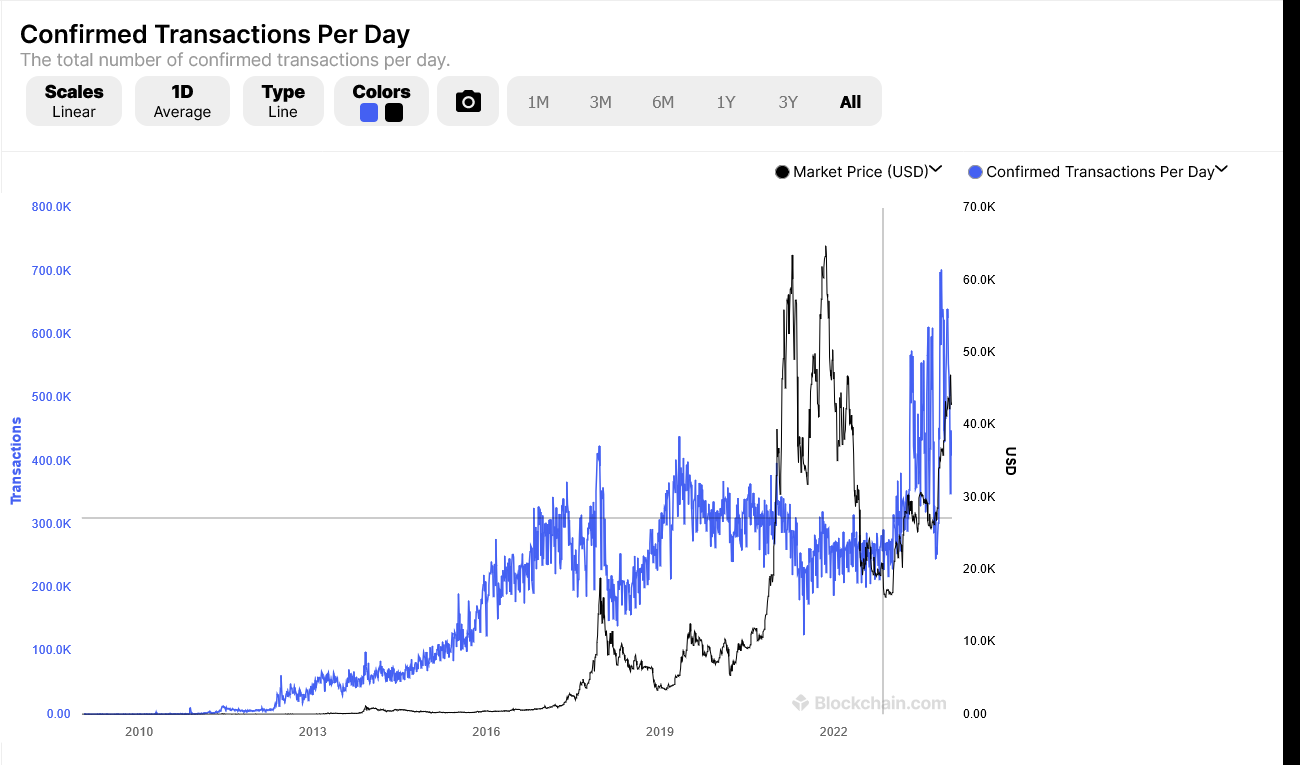

Another measure tracking Bitcoin transactions shows a similarly favorable trend. According to Blockchain.com, which tracks Confirmed Transactions Per Day, Bitcoin transactions have been steadily increasing over the past 10 years.

Cryptocurrency adoption is clearly up around the world, but it’s not the only measure of public interest. Google Trends tracks interest keywords over time, and “Bitcoin” has been having a resurgence lately. Pinging a value of 45 last week, it’s the highest it’s been since June 2022 and halfway on the way to reaching the highest level of interest (with a value of a 100) set in May 2021.

To summarize, public interest is up, adoption is up, and regulation is up – all over the world. Cryptocurrency, in other words, is on a rising tide, and it’s getting lifted even higher thanks to added perks like the Bitcoin spot ETF approvals. There’s more potential boosts on the way, too, as analysts are looking at the Bitcoin halving on the horizon in April the precursor to a proper bull market.

With all of these factors coming together, it’s safe to say that cryptocurrency has successfully returned to the center stage.