Even if you haven’t been paying close attention, you probably know that cryptocurrency is booming right now. After a long hibernation for crypto winter, Bitcoin and other altcoins are reaching new heights and everyone’s talking about crypto again. Experts are debating whether it’s in the midst of a bull market or a bubble, with Bitcoin in particular having experienced cycles of dramatic boom and bust in the past. Regardless of whether Bitcoin is enjoying a veritable bull market or if its bubble is poised to burst at some point, however, one thing is clear: Bitcoin’s long term gains outperform its losses without a shadow of a doubt.

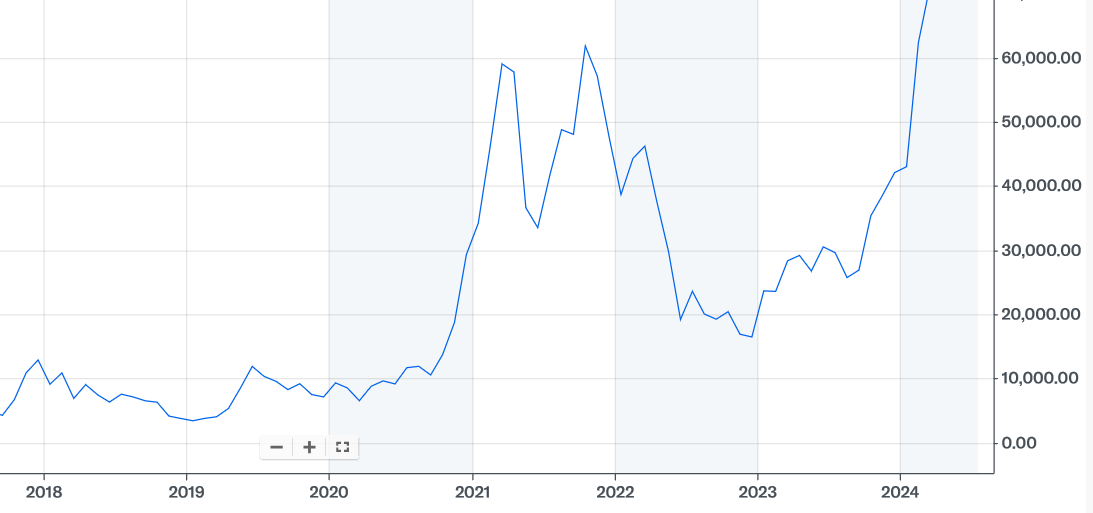

Let’s look at the current situation. This past week, Bitcoin hit an all-time high of nearly $74,000, surpassing the 2021 record by almost $10,000 and clearing 2023’s high point of $41,000 by leaps and bounds.

It’s not the first time Bitcoin has soared, of course, and some investors continue to feel burned by the 2022 crash that saw it plummet to under $16,000. In fact, Bitcoin is notorious for having regular cycles of ups and downs, being somewhat tied to a cycle governed by the coin’s regular halving pattern.

This cycle appears to be different, however. Unlike previous bubbles that were inflated by FOMO and optimism, this particular rise is being driven by some rock-solid supports. One is the launch of the first spot Bitcoin ETFs earlier this year, which have already been responsible for some of the largest single-day ETF transfers in history.

The cryptocurrency ETF demand has been so high, in fact, that it appears to be consuming all available Bitcoin, to the point that the supply may dry up in as little as six months. If that happens, in accordance with Economics 101, the price will go up accordingly.

Another factor is the increasing number of individual wallets making Bitcoin trades. As of last year, there were 44 million individual wallets with non-zero balances. That alone indicates that Bitcoin is being adopted on a large scale around the world – in part due to high inflation and financial instability in some countries, prompting people to look for alternatives to crumbling fiat currencies.

It’s not just the number of wallets that’s noteworthy right now – it’s also the number of millionaire wallets being produced that’s worth paying attention to. Every single day, 1,500 Bitcoin wallets are crossing into the million-dollar category. (Is your wallet one of them?) Put simply, the line is going up.

But will it go back down? In accordance with Bitcoin’s cyclical pattern, once the halving happens in April, the coin may be facing a decline – although in past cycles, neither the option for spot ETFs nor the spread of Bitcoin to wallets all over the world were in place. Other positive factors supporting the coin include increasing acceptance at the governmental and institutional level and an ongoing push toward regulation in the U.S.

That could mean that the Bitcoin dip, if it happens, will not be as severe as the dips have been in the past. Even if it does go down dramatically, however, Bitcoin’s dips are higher than its past peaks. In the chart below, for example, we see even 2022’s dramatic low is still higher than the peaks hit in 2017 and 2019.

Source: Yahoo Finance

In fact, the volatility may be helping Bitcoin move higher and higher, as each boom and bust cycle seems to set a new, and higher, floor for the token. Unbridled enthusiasm might drive the price up, but after the excitement dies down and some people cash out, Bitcoin’s left standing higher than it’s previous falls, which encourages confidence and fuels growth. Flattened out over the long term, Bitcoin’s trajectory looks a lot more stable – and definitely headed in the upward direction.

What’s happening to Bitcoin and crypto in general may not fit the definition of a bull market based on a few qualifying metrics, but does that actually matter to long term investors who are seeing their portfolios rise? Investors just care about the line going up, even if it has to ride a few bubbles to get there.

With so many factors driving Bitcoin up this year, there is truly no time like the present to consider investing. And if you miss this particular boom and the bubble bursts before you do, don’t worry – there will likely be another one in the future to drive the price up even further.